top of page

JSE Sectors: Factors, Momentum & Reward-to-Risk

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 18

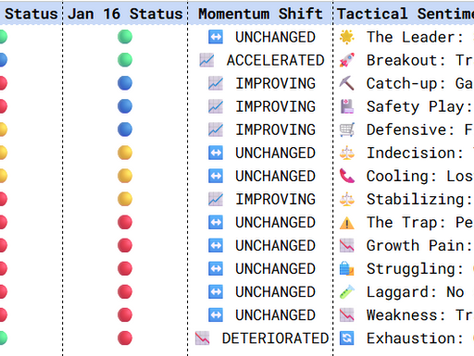

Year-To-Date: Sector Momentum Changes

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 18

Market Internals

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Market Breadth : Majority of tickers in Leading/Weakening quadrants suggest a mature but supported bull market. 📈 Sector Rotation : Financials/Materials lead; Retail/Consumer Services show early Improving signs from oversold levels. 🔄 Reward-to-Risk : Average R:R for Buy on Pullback is 4.5:1 , signifi

Lester Davids

Jan 18

Take Profit on Investec Ltd: Running +9% and Rebounding In Line With Price Action Model

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Applicable to medium term traders. Note: The share has rebounded in line with the price action model which, on the long term (5 to 8 week time frame), highlighted the probability of a small rebound (see price action model in the original note further below). Previous Post (02 December): Investec Ltd: Ea

Lester Davids

Jan 16

Trade Ideas + Voting Poll

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Please share this post in your social circle by using the following link: https://www.unum.capital/post/ideas1601 NEW RESEARCH The data set below is based on the daily time frame and is subject to change based on the subsequent price action and news flow. For the key levels, select a maximum of two (2

Lester Davids

Jan 15

Take Profit: ASML Running +92%

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za In less than 15 month, ASML has rallied by 92%, with it's market cap rising above $500 billion. Previous Post: Global Ideas: ASML Thursday 31 October 2024 Time Published: Pre-Market Share: ASML Holding Exchange: Euronext Ticker: ASML Sector: Semiconductors Tactical Trading Guide 3x Time Frame Reading: D

Lester Davids

Jan 15

Take Profit on VanEck Steel ETF: Running +26%

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Previous Post (27 September): VanEck Steel ETF: Multi-Year Base Looking To Break Out (See Monthly Chart) Previous Post (11 July): Global Idea: ArcelorMittal (ADR); Strong Price Action Within Weekly Consolidation Last Price: $34.41 Target: $53.00 Stop-loss: $25.12 Lester Davids Senior Investment Analyst:

Lester Davids

Jan 15

Buy Idea: iShares Core Dividend Growth ETF (Acceleration Phase)

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Buy at $71.26 or lower Stop-loss: $64 Target(s): $85.00 and $89.00 Code: DGRO Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 15

Bid Corp: Improving Candle Structure In An Oversold Range + Relative Distance at Extremes

Research Notes December 2025 > https://www.unum.capital/post/rdec2025 Trade Local & Global Financial Markets with Unum Capital. To get started, email tr adingdesk@unum.co.za Most recently, the share gave us a trading opportunity for a 5% tactical rebound. Longer term, the share, on a relative basis, is trading at extremes vs it's 200-day moving average. Indicator: 200-Day Moving Average Distance (Relative) Current Reading: -23.98% DOMINANT TREND: ACCELERATED UNDERPERFORMA

Lester Davids

Jan 15

Buy Idea: Sprott Junior Uranium Miners ETF

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Buy at current level ($30.81 ) or lower Stop-loss: $26.00 Target(s): $40.00 and $42.00 Previous Post 07 October 2025: Global X Uranium ETF Running +80% & Fresh All Time High The ETF is higher by 80% since our note on 09 February...Well done to clients who are capitalizing on the opportunities at hand. P

Lester Davids

Jan 15

Buy Pullbacks In This Retail Share

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Woolworths is now running +20% from our original note. If if you missed the move off the lows, buy pullbacks into rising moving averages. The fundamental (and technical) recovery is underway. Woolworths Notes As Published/Communicated To Clients: 06-November https://www.unum.capital/post/woolwo 20 Oct

Lester Davids

Jan 15

Underneath The Surface on the JSE: 10 Things You Need To Know

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za 📊 A comprehensive analysis of the JSE universe across 115 tickers reveals a market characterized by high-velocity momentum in core sectors, though significant exhaustion is beginning to manifest in the 'Leading' quadrant. Breadth remains relatively healthy, but the dispersion between performance leade

Lester Davids

Jan 15

JSE Top 40 Index: Momentum Exhaustion + Approaching Medium Term Sell/Reduce

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Analysis of Daily Time Frame Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal line

Lester Davids

Jan 15

Global Idea: VanEck Agribusiness ETF

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Buy at $77.03 or lower Stop-loss: $68 Target(s): $88.00 and $92.00 Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 15

Long Term Value Territory: Portfolio Buy Idea

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za At current levels, the share is trading 46% below it's 200-week Simple Moving Average, relative to the JSE Top 40 Index. During previous cycles, readings in this % distance range coincided with a cycle low and buy for the share. The distance is extended and valuation is compelling to consider for a port

Lester Davids

Jan 15

16x Your Money

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Impala Platinum: Long term, multi-year holders of the share could consider reducing their portfolio positions as the price starts to enter a medium and long term overbought conditions. To further elaborate, reducing positions by say, 30%, while holding the remaining with a trailing stop. Long term momen

Lester Davids

Jan 15

Take Profit on iShares Microcaps ETF: Running +26%

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Target Exceeded Previous Post (11 July) Strong candle structure below multi-month highs, breakout pending. Long term target = $159.00 Stop-loss = a weekly close below $118.00 Last close = $134.21 Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 14

Take Profit on ArcelorMittal (ADR); Running +42%

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Previous Post (11 July 2025) Global Idea: ArcelorMittal (ADR); Strong Price Action Within Weekly Consolidation Last Price: $34.41 Target: $53.00 Stop-loss: $25.12 Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 14

Underneath The Surface: Here's What's Happening on the JSE

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za If you are looking for a gentle rotation, this market isn’t it. Between January 9 and January 13, the JSE underwent a violent structural shift. What began as a mixed board has rapidly bifurcated into a "barbell" market, where liquidity is fleeing the center and aggressively choosing sides. We have witne

Lester Davids

Jan 14

JSE Commodity Share: Measured Move Target = R175

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za A strong acceleration into R130 is likely to see the share break above resistance. For medium term traders, a measured move targets R175 to R180. Existing clients would be aware that we discussed the share just under 12 months ago (10 February 2025), zooming out to highlighting the multi-year support zo

Lester Davids

Jan 14

bottom of page