top of page

Technical Screen: Re-Emerging Strength

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

2 days ago

Technical Screen: Technically Expensive (Risk of Short Term Pullback)

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

2 days ago

JSE Bank Index: Technical Risk (See Monthly Chart)

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Monthly Chart trading at upper boundary of multi--year channel. In addition, the 7-month RSI is the most overbought in 19 years. Fundamental valuations remain relatively attractive however caution to new longs i.e. there are better entries at lower levels. Trading Notes/Resources (Where Applicable) REA

Lester Davids

2 days ago

📝JSE Consumer Sector: Base, Bull & Bear Cases

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

2 days ago

JSE Paper & Pulp - Relative Value

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

2 days ago

Running +12%: Oil & Gas Exploration ETF (XOP); Take Partial Profits & Hold Remainder Until Full Target Reached

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Previous Post (22 January): Global Idea: State Street Oil & Gas Exploration & Production ETF (XOP) Buy at current level of $134.63 or lower Stop-loss: $121.00 Target(s): $160.00 & 165.00 Code: XOP Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

3 days ago

Naspers: Early Base Building

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za NPN Weekly Previous Post (11 February): Deeply Oversold: Early Buy Trigger + Lower Levels Expected Before Potential Rebound Deeply Oversold...Naspers Ltd (NPN) Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuou

Lester Davids

3 days ago

Short Term Traders Take Profit: Silver Running 7% Over Two Days

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Previous Post (17 February):🎥Video: Trading Silver (Short Term) Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense valu

Lester Davids

3 days ago

💡Strategy Alert: Running +30% Over 10 Weeks. Short Term Traders Take (Partial) Profits

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Sasol Ltd (SOL) Previous Post (05 December 2025): Strategy Alert: Sasol This note is being published pre-market (Friday, 05 December) therefore there is no price action to provide confirmation. We do however, want to remain mindful of the potential for a 'PIERCING LINE (BULLISH REVERSAL)' TECHNICAL FOR

Lester Davids

3 days ago

Trading FirstRand: Here's What The Data Says

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

3 days ago

📝Trading Notes: Breakout Levels

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Published on 18 February (post-market), for 19-February Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The

Lester Davids

4 days ago

Dashboard: Base, Bull & Bear Case

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Published on 18 February (post-market), for 19-February Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

4 days ago

🎥Video: Satrix Financials ETF

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za SBK Video Reference Previous Post (15 October 2025): 🎥Video: Breaking Out; Target 2800c Premium Research Content. To access the ticker, email lester@unum.co.za Thank you for your interest in our research. While the vast majority of our +1500 notes published year-to-date are complimentary, this premium

Lester Davids

4 days ago

Running +12% and Generating Cash

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Old Mutual (OMU) - Running strongly according our model. Consider taking full or partial profits into strength. Previous Post (14 December 2025): JSE Insurer: Bullish Alignment on Weekly Chart OMU DAILY OMU WEEKLY Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active

Lester Davids

4 days ago

Take Profit: OUTsurance Rebounding +10% (Medium Term Traders)

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Medium term traders, consider taking partial or full profits. Previous Post (07 January 2026): OUTsurance: Early Buy Trigger. Lower Levels Expected Before Oversold Rebound Analyst's Price Action Model Technical Take: Outsurance (OUT, 6828c) Date: Wednesday, January 7, 2026 Regime: Oversold / Capitul

Lester Davids

4 days ago

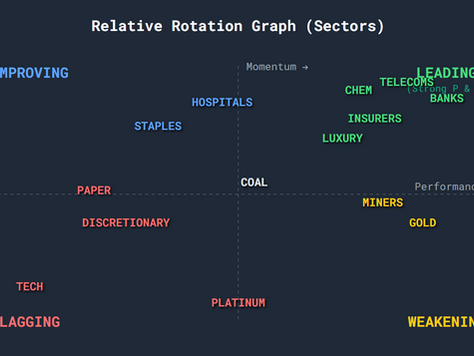

JSE Sectors: Leaders & Laggards + Rotation

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za The undeniable leaders of the YTD period are the Banks and Telecommunications sectors. At the end of 2025, Banks were rated Neutral across all timeframes, painting a picture of a sector in equilibrium. Fast forward to February, and Banks have erupted into a "High Bullish" state on medium and short-term

Lester Davids

5 days ago

JSE Relative Sector Analysis

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za The first six weeks of 2026 have witnessed a definitive shift in market character. At the close of 2025, the market displayed tentative defensiveness with scattered strength in precious metals. By mid-February, this has morphed into an aggressive "risk-on" bid for South African domestic plays ("SA Inc"

Lester Davids

5 days ago

JSE Sectors: Wakey, Wakey...

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Looking beyond the obvious breakouts, the Luxury Goods and Insurers sectors are clearly "waking up." Luxury Goods ended 2025 with a Weak long-term signal, but the February data shows a pivot to "Strong" in the medium and short terms. This implies that while the mass-market consumer is struggling, the h

Lester Davids

5 days ago

🎥Video: Trading Silver (Short Term)

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

5 days ago

Trading Harmony Gold

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

5 days ago

bottom of page