Gold Fields (GFI): Tactical Trigger Sees +30% Gain - Thursday, 01 August 2024

- Lester Davids

- Aug 1, 2024

- 1 min read

Updated: Aug 5, 2024

At the end of day on Friday, 14 June (the next session was Tuesday 18 June AS Monday 16 June was a public holiday), clients were alert to the reading from the Tactical Trading Guide for GFI which read as follows:

SHORT TERM (1 to 10 days): "Aggressive selling, but long reward-to-risk may be attractive"

MEDIUM TERM (2 to 4 weeks): "The share has been sold aggressively. Look for a continued dip before a minor rebound".

LONG TERM (5 to 8 weeks): "The share has been weak, with strong selling pressure however, there is a possibility of a small rebound".

Since then, the share has risen by 31% to reach a high of 32232c (from 24499c).

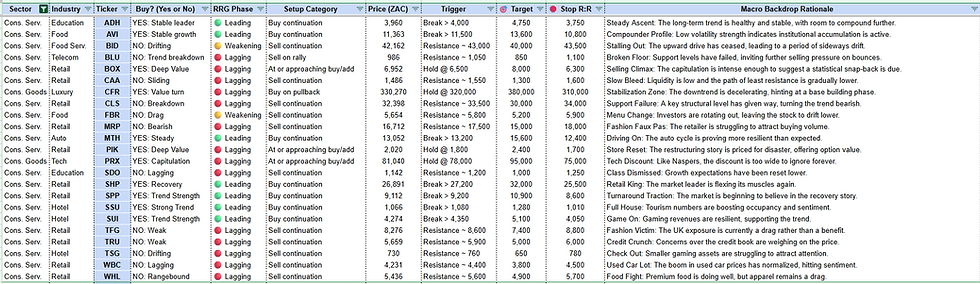

Here's what Unum Capital clients had access to:

Here's how the setup has subsequently developed:

Also Note: The share is nearing it's 61.8% Fibonacci Retracement Level (a possible resistance range).

I previously wrote about the Tactical Trading Guide in this note, highlighting several time-stamped examples: https://www.unum.capital/post/systematic-insights-timely-signals-from-the-tactical-trading-guide

Lester Davids

Analyst: Unum Capital

Comments