Naspers: Next Provisional Re-Accumulation Range - Thursday, 29 August 2024

- Lester Davids

- Aug 29, 2024

- 1 min read

Real-Time: 12h57

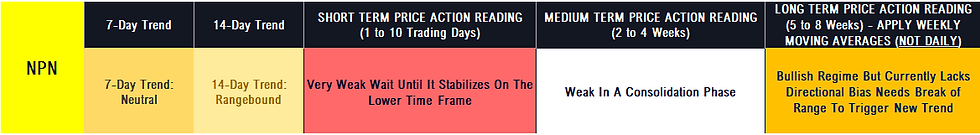

Ticker: NPN

Previous Post (15 August 2024)

On Tuesday evening, the Tactical Trading Guide warned traders not to chase/buy, but instead look for an overshoot with a tactical short/sell back to the 8-day EMA.

The level between R3555 and R3580 is approximately where the 8, 21-EMA is situated. A re-test of this range could offer a buy/long re-entry for short term traders. (Monitor the Tencent price action for clues). Note: this is also the previous breakout level.

Previous Post (Wednesday, 14 August 2024)

Real-Time: 11h03

+12% Gain Off Tactical Trigger

Previous Post

The buy trigger on end of day Monday 01 July (also highlighted in real-time on telegram) saw a healthy short term bullish reversal with the price advancing by R161 or +4.6% to yesterday's high. Note yesterday's high was the declining 21-day exponential moving average which has always been a level into which short term traders look to reduce into. The price continues to trade around it's 8-day EMA, which has started to lose downside momentum and which has previously acted a resistance on the recent downward trend. Broadly, the candle structure remains mixed, with a slightly bearish bias. I will continue to seek tradeable opportunities should the model or manual review indicate.

Note: The share has unwound significantly from my sell/reduce view on 14 May (peaked two days later) and now trades within the initial accumulation range. The timestamped chart is shown below:

Lester Davids

Analyst: Unum Capital

Comments