POSITIONING: High Beta vs Low Volatility - Tuesday, 30 July 2024

- Lester Davids

- Jul 30, 2024

- 1 min read

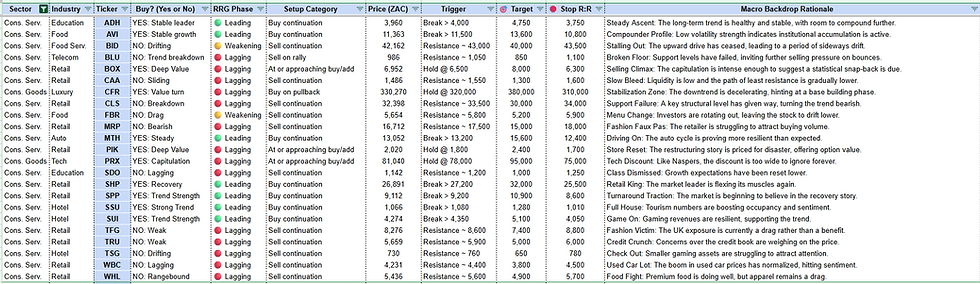

The chart highlights the S&P 500 High Beta ETF (SPHB) relative to the S&P 500 Low Volatility ETF (SPLV). Zooming out, my analysis highlights the failure of high beta shares to hold above the prior swing highs, while momentum (as per the 14-week RSI) is nearing a breach of the upward trend.

Bottom Line: Investors appear to be positioning themselves within low volatility shares/sectors while rotating out of shares/sector with a higher beta.

Lester Davids

Analyst: Unum Capital

Comments