Trading Standard Bank? Here's What The Data Says

- Lester Davids

- Jun 19, 2025

- 2 min read

Research Notes For 16 to 20 June > https://www.unum.capital/post/r1620june

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

Overall Trading Considerations:

Dominant short-term weakness: Both short and slightly longer short-term trends are negative, signaling continued downward pressure.

Patience is key: The model strongly advises against entering new positions in the short to medium term, emphasizing the need to wait for price stabilization.

Long-term conditional opportunity: A potential buying opportunity may arise in the longer term, but it is strictly conditional on the price finding support at a key technical level (50-EMA) and subsequently showing signs of a rebound.

Overall Trading Considerations

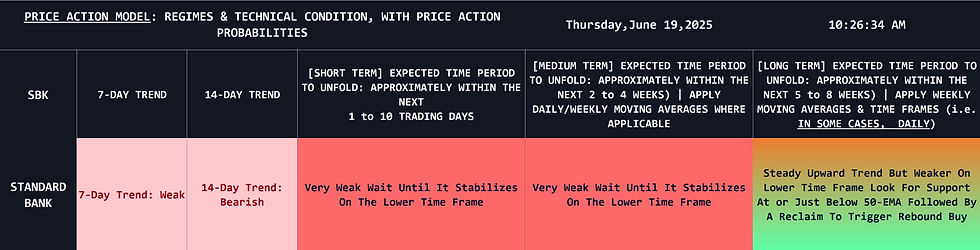

Here's a breakdown of the current price action for Standard Bank (SBK): The 7-day trend is indicated as "Weak," while the 14-day trend is "Bearish."

Comparison: The short-term (7-day) weakness is confirmed and intensified by the "Bearish" 14-day trend. This alignment suggests consistent and building downward pressure on the price across these initial timeframes. The recent weakness is part of a broader negative sentiment.

Potential Trading Approach

Short Term (Approximately Next 1 to 10 Trading Days): The model notes, "Very Weak Wait Until It Stabilizes On The Lower Time Frame."

Approach: The outlook is explicitly weak. The recommended approach is to take no action and remain on the sidelines. Traders should wait for the price to show clear signs of stabilization on a lower timeframe before considering any new positions. This indicates a high-risk environment for both buyers and sellers.

Medium Term (Approximately Next 2 to 4 Weeks): The model indicates, "Very Weak Wait Until It Stabilizes On The Lower Time Frame."

Approach: The medium-term outlook mirrors the short-term view, suggesting that the period of pronounced weakness is expected to persist. The strategy remains the same: to wait for the price action to consolidate and form a base, signaling that the downward momentum may be subsiding.

Long Term (Approximately Next 5 to 8 Weeks): The model states, "Steady Upward Trend But Weaker On Lower Time Frame Look For Support At Or Just Below 50-EMA Followed By A Reclaim To Trigger Rebound Buy."

Approach: Despite the short-term weakness, the underlying long-term trend is viewed as steadily upward. The current price action is seen as a pullback within that larger trend. The recommended strategy is to watch for the price to find support at or slightly below the 50-period Exponential Moving Average (EMA). A buying opportunity, or a "rebound buy," would only be triggered after the price finds this support and then decisively moves back above ("reclaims") that level.

In summary, the current view is bearish for the short to medium term. However, long-term investors should monitor for a potential rebound opportunity off the 50-WEEK EMA after the current period of weakness subsides.

The model points to a general downward trend for the share price in the immediate future, with the potential for a long-term reversal at or just below the 50-week EMA.

Lester Davids

Senior Investment Analyst: Unum Capital

Comments