South African 10-Year Bond Yield

- Lester Davids

- Jun 15, 2025

- 2 min read

Research Notes For 16 to 20 June > https://www.unum.capital/post/r1620june

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

Overall Trading Considerations

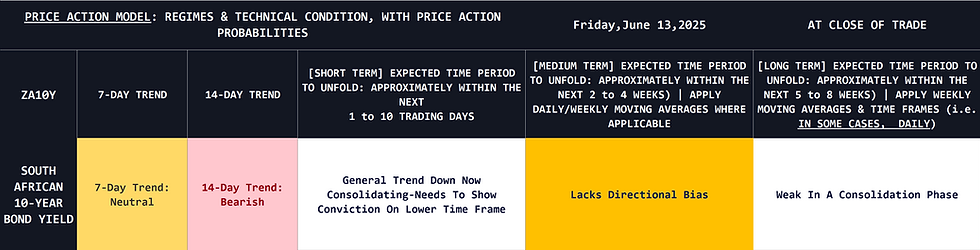

Here's a breakdown of the current price action: The 7-day trend is indicated as "Neutral," while the 14-day trend is "Bearish."

Comparison: The underlying short-to-medium term (14-day) trend for the bond yield is bearish, indicating downward pressure. However, the more immediate 7-day trend has shifted to "Neutral," which suggests the downward momentum has paused and the market is now in a consolidation phase.

Potential Trading Approach:

Short Term (Approximately Next 1 to 10 Trading Days): The model notes, "General Trend Down Now Consolidating-Needs To Show Conviction On Lower Time Frame."

Approach: The primary trend for the yield is down, but it is currently moving sideways. The recommended approach is to wait for a clear, convincing move on a lower time frame to confirm the next direction. This implies patience is required before committing to a trade, as the market currently lacks conviction.

Medium Term (Approximately Next 2 to 4 Weeks): The model indicates the market "Lacks Directional Bias."

Approach: This reinforces the short-term view. The market is expected to remain in a range without a clear trend. The appropriate strategy is to wait on the sidelines until the consolidation resolves and a new, clear trend emerges.

Long Term (Approximately Next 5 to 8 Weeks): The model states the yield is "Weak In A Consolidation Phase."

Approach: The long-term perspective confirms the underlying weakness but emphasizes that the market is stuck in a consolidation. A long-term trader would wait for a definitive break from this phase to signal the start of the next major move.

Overall Trading Considerations:

Underlying bearish momentum: The 14-day trend is bearish, and the long-term view is weak, supporting lower yields over time.

Widespread consolidation: All timeframes point to a current sideways consolidation, indicating a pause in the primary trend.

Patience is key: The model consistently advises waiting for a clear signal or "conviction" before entering a trade, as the market currently lacks direction.

In summary, for the ZA10Y, the current view is bearish but stalled. The dominant strategy across all timeframes is to wait for the current consolidation to end before making a trading decision.

The model points to a general downward trend for the yield of the South African 10-Year Bond.

Comments