top of page

🎥Video: Sasol's Relative Strength

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

5 days ago

Bonus Note: Base + Bull + Bear Case

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za This data set is based on the DAILY TIME FRAME and is subject to change based on the subsequent news flow and price action. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

5 days ago

Trading Sibanye Stillwater

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

5 days ago

Strategy Alert: Absa Group

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Recently, the share exceeded our LONG TERM target of R220 and currently trades at R265. Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against

Lester Davids

5 days ago

Standard Bank: Near Term Spike Could Create Short/Sell Opportunity

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Near Term Spike Into Medium Term Overbought Conditions Could Create Short/Sell Opportunity Analyst's Price Action Model SBK Daily Chart Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the

Lester Davids

6 days ago

Gold & Platinum Miners: Momentum Dashboard 🟢🟡🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Based on the WEEKLY time frame and is subject to change based on the subsequent news flow and price action. Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ leve

Lester Davids

7 days ago

Consumer: Momentum Dashboard 🟢🟡🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Based on the WEEKLY time frame and is subject to change based on the subsequent news flow and price action. Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ leve

Lester Davids

7 days ago

Financials: Momentum Dashboard 🟢🟡🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Based on the WEEKLY time frame and is subject to change based on the subsequent news flow and price action. Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ leve

Lester Davids

7 days ago

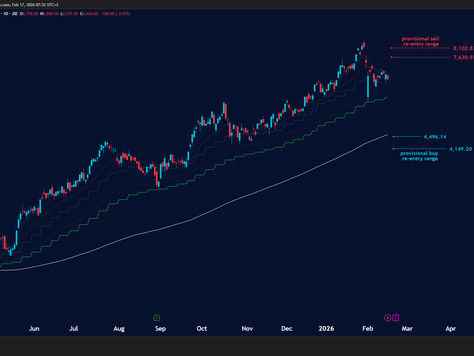

Trading Spot Gold

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

7 days ago

Rotation: These Are The Leading Sectors

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Source: Lester Davids Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

7 days ago

Trading Thungela Resources: Sustainable Recovery

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Thungela Resources (TGA) is currently in a **"Goldilocks" technical phase**. The short-term momentum is robust (High Bullish), confirming buyer conviction, while the medium and long-term trends are "Strong" but **not yet Overbought**. This suggests the rally has structural support and ample runway rem

Lester Davids

7 days ago

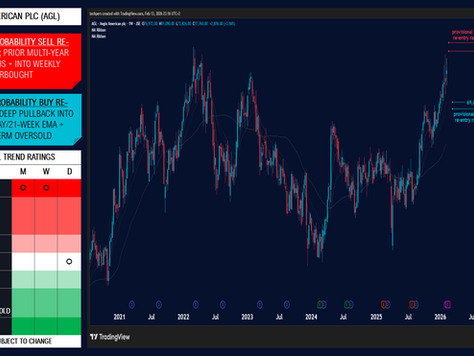

Trading Anglo American Plc: Approaching Overbought

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Bottom Line: Anglo American PLC (AGL) is in a powerful, high-velocity uptrend. However, with Tactical, Fast, and Structural momentum indicators all flashing **"Overbought"**, the probabilities suggest the market is extended. While the Primary Trend supports a long-term bullish bias, traders should be

Lester Davids

7 days ago

Global Risk Index: Multi-Time Frame Sentiment

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

7 days ago

Trading JSE Banks: Scenario Analysis

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Base, Bull & Bear Case Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on

Lester Davids

7 days ago

Trading JSE Insurers: Scenario Analysis

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Base, Bull & Bear Case Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on

Lester Davids

7 days ago

🔎Factor Analysis

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za via Our ETF Screens Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

7 days ago

JSE Top 40 Index: Correction in a Multi-Year Bull Phase

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Published: Friday, 13 February 2026 Time: 14h38 Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and

Lester Davids

Feb 13

Take Profit: Target Reached at $42 (ETF Idea)

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Previous Post (12 August): Taking A Look At Turkey: Bullish Momentum + Potential Break of Downward Channel iShares Turkey ETF (TUR) Current Price: $34.85 Stop-loss: $30.15 Trigger: +36.20 Target: $42.00 Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Feb 13

Trading African Rainbow Minerals

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Most recently, we highlighted the overextension risk in ARI, suggesting a sell/reduce at R267. The updated analysis is shown further below the chart. African Rainbow Minerals: Update Analysis Status: Structural Expansion / Tactical Pullback Current Price: 21,985 ZAC (-4.04% Daily) African Rainbow Mi

Lester Davids

Feb 13

🎥Video: Sibanye Stillwater

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

Feb 13

bottom of page