Sector Review: JSE Banks - Short Term Weakness

- Lester Davids

- Jun 23, 2025

- 1 min read

Research Notes For 23 to 27 June > https://www.unum.capital/post/r2327june

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

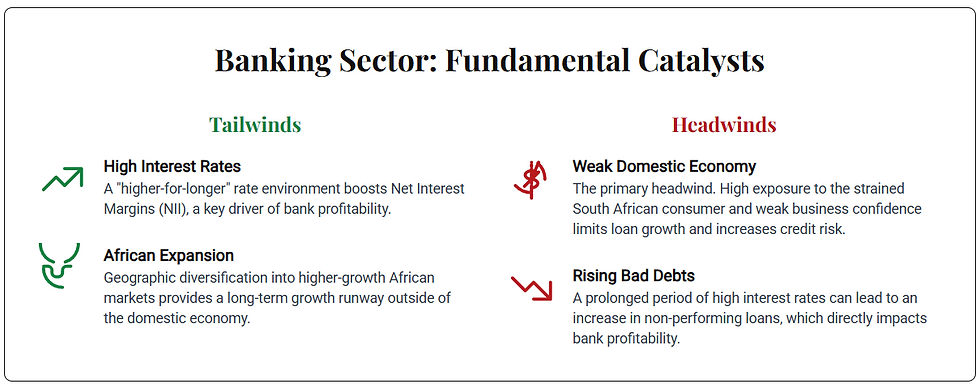

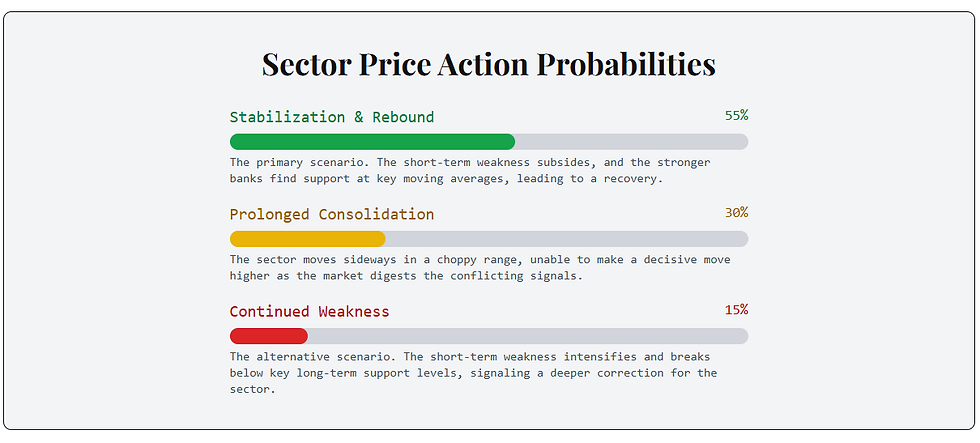

The South African banking sector, as represented by its four largest constituents, is undergoing a period of uniform short-term weakness. A sharp, sector-wide pullback has shifted the immediate technical outlook to "Very Weak," necessitating a cautious, patient approach from investors and traders.

However, beneath this surface-level weakness, a clear divergence in the longer-term technical health of the individual banks is apparent.

Two distinct narratives are emerging:

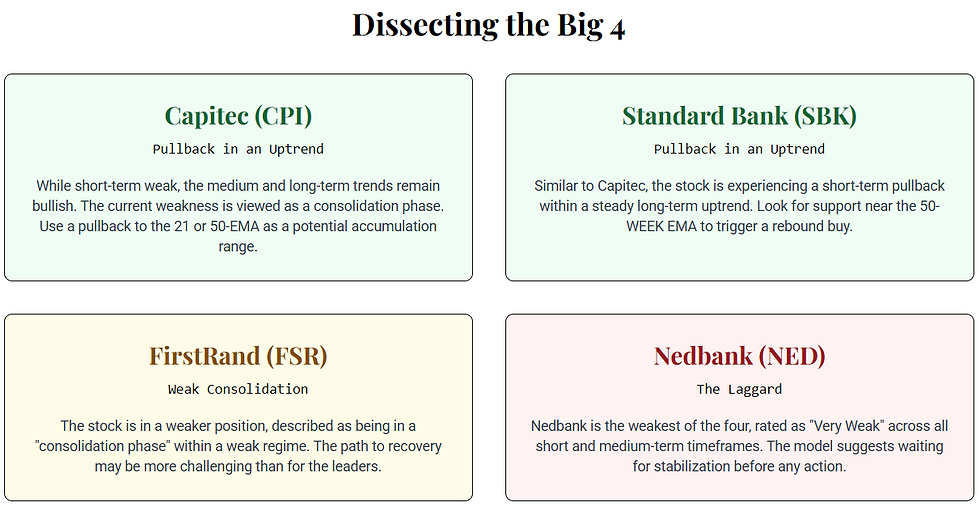

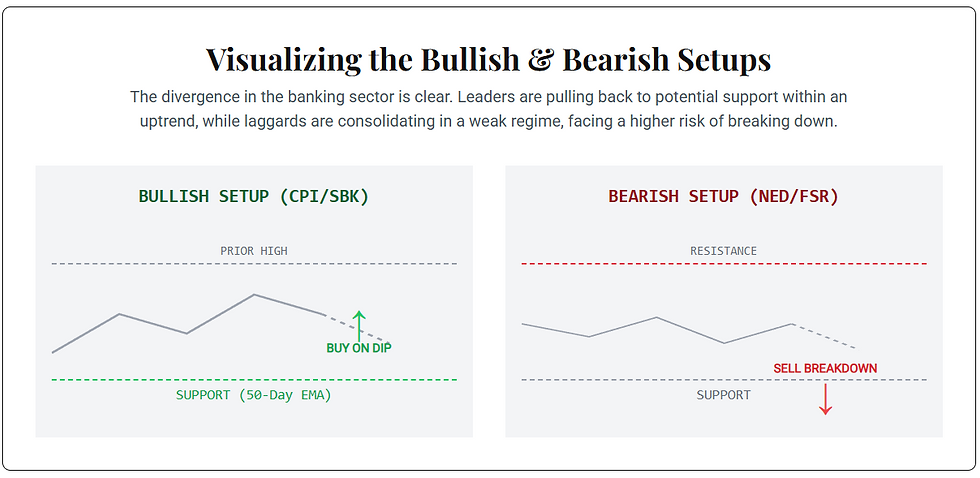

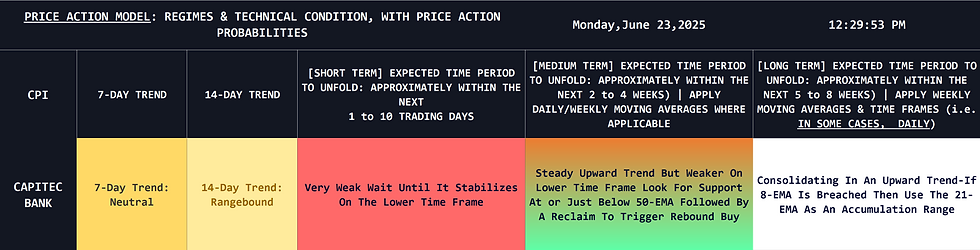

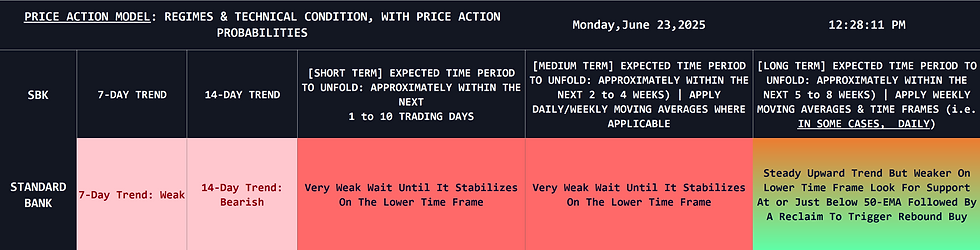

Constructive Pullback: For market leaders like Capitec and Standard Bank, the current downturn appears to be a healthy and constructive pullback within a broader, established uptrend.

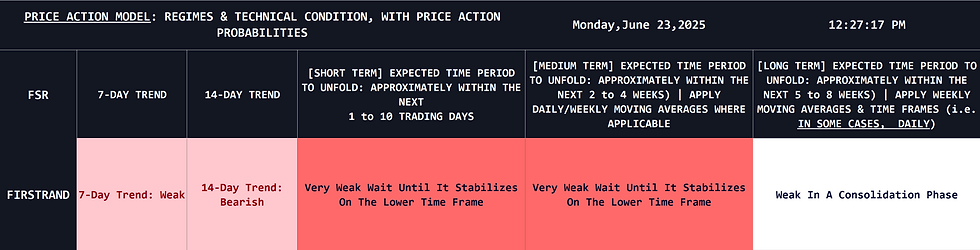

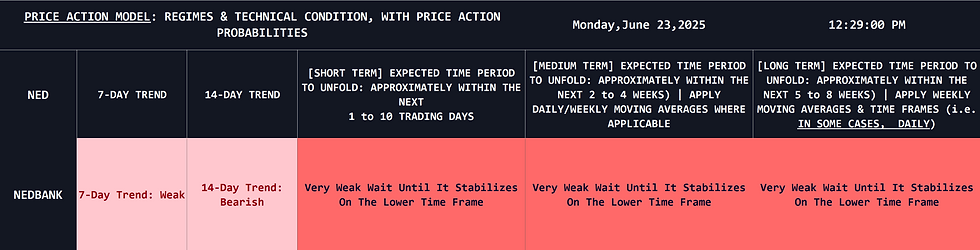

Significant Weakness: For the laggards, Nedbank and FirstRand, the price action is more concerning, showing signs of deeper technical damage that may prove more challenging to repair.

The primary strategy across the sector is to wait for the current wave of selling to abate. Once stabilization occurs, the most prudent course of action would be to focus on the strongest names (Capitec, Standard Bank) for potential "buy the dip" opportunities, as they are best positioned to lead any subsequent recovery.

Lester Davids

Senior Investment Analyst: Unum Capital

Comments