Emerging Markets ETF: Target Reached ($48) + Momentum Accelerating

- Lester Davids

- Aug 14, 2025

- 1 min read

Research Notes 11 - 15 August > https://www.unum.capital/post/r1115august

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

In September of last year, our positive outlook for Emerging Market assets included the lowering of interest rates by the U.S Federal Reserve. With US growth potentially slowing as well as other factors, we saw US treasury secretary Scott Bessent calling for interest rate cuts. Although we initially saw volatility, the target of $48 has been exceeded with momentum also accelerating to the upside.

Previous Post (Friday, 20 September 2024): Emerging Markets: A Beneficiary Of U.S. Interest Rate Cuts

Pre-Market U.S. Trading Session / Real-Time (South African; 15h02)

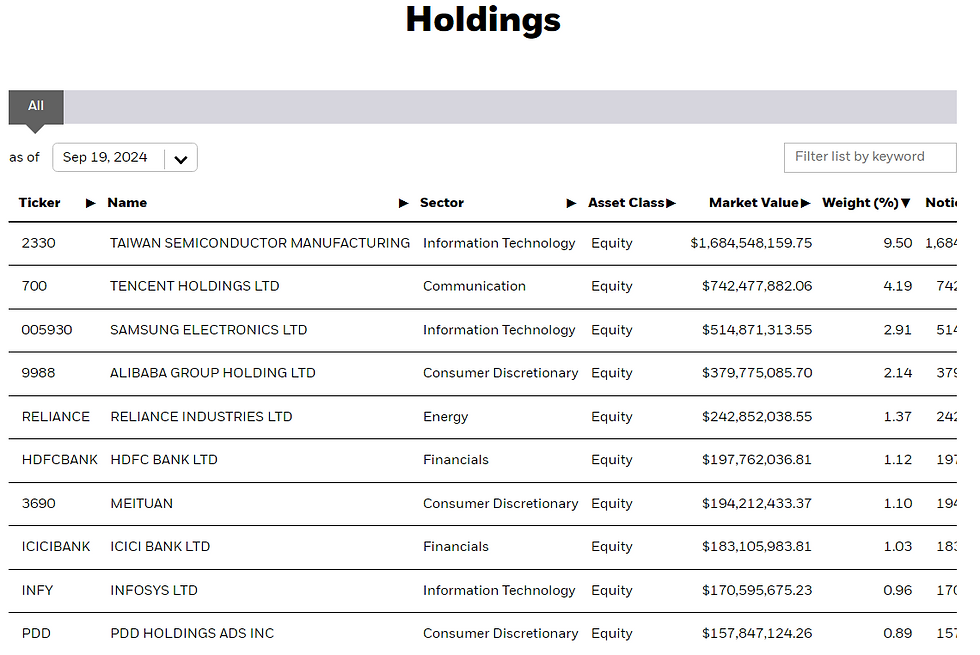

With the Federal Reserve cutting interest rates, money could potentially flow out of developed markets, into high yielding EM geographies.

In addition, high valuations in the U.S. may be a driver for flows into markets with a lower valuation/rating.

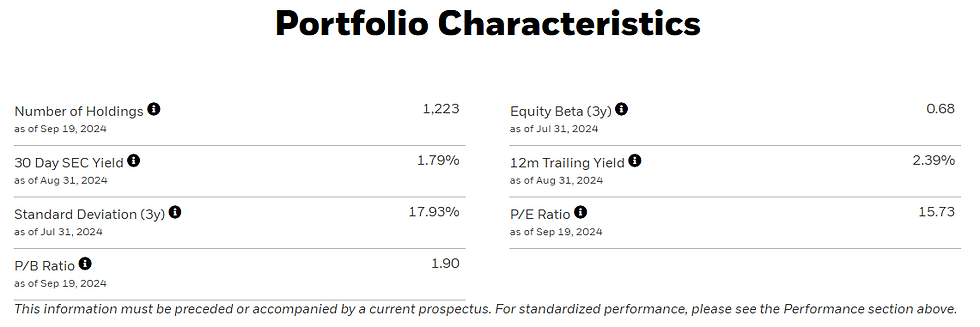

The Emerging Markets ETF (EEM) trades at a substantial discount to the S&P 500.

Current level: $43.78

Medium Term Target: +$48

Stop-loss/invalidated below: $37

Lester Davids

Analyst: Unum Capital

Comments