Trading EUR/USD: Buyers In Control But Caution On Lower Time Frames

- Lester Davids

- Jun 17, 2025

- 1 min read

Research Notes For 16 to 20 June > https://www.unum.capital/post/r1620june

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

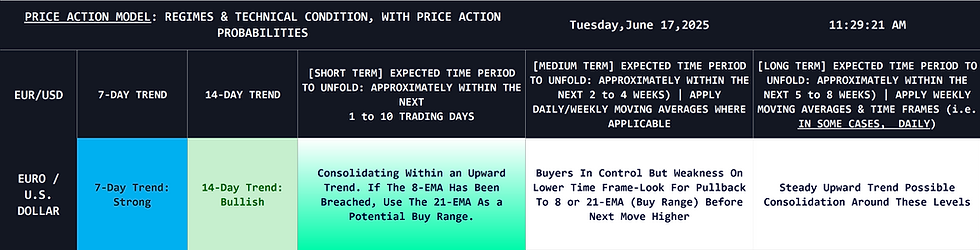

Here's a breakdown of the current price action: The 7-day trend is indicated as "Strong," while the 14-day trend is "Bullish."

Comparison: The short-term trend (7-day) is "Strong" and the slightly longer short-term trend (14-day) is "Bullish." This indicates solid upward momentum. The "Strong" 7-day trend suggests that recent buying pressure is potent, while the "Bullish" 14-day trend confirms this strength is part of a broader upward movement, though perhaps not as accelerated as the most recent trend.

Overall Trading Considerations:

Underlying Bullish Tone: The trend across all timeframes is upward, indicating a generally bullish market.

Consolidation and Pullbacks: A key theme is the expectation of consolidation and pullbacks. The model consistently advises against chasing the price and instead recommends using dips to specific moving averages (8 and 21-EMA) as entry points.

Buyer Control with Caution: While buyers are in control, the model signals short-term weakness, reinforcing a patient, dip-buying approach.

Steady Long-Term Ascent: The long-term view is positive but tempered with the possibility of consolidation, suggesting a grinding, steady move up rather than a parabolic one.

In summary, for EUR/USD, the current view is bullish across the observed timeframes, but it is characterized by consolidation and expected pullbacks. Traders should be patient and look for buying opportunities on dips to the 8 or 21-EMA.

The model points to a general upward trend for the price of EUR/USD.

Lester Davids

Senior Investment Analyst: Unum Capital

Comments