Trading Growthpoint Properties

- Lester Davids

- Jun 23, 2025

- 3 min read

Research Notes For 23 to 27 June > https://www.unum.capital/post/r2327june

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

Trapped in a Weak Consolidation

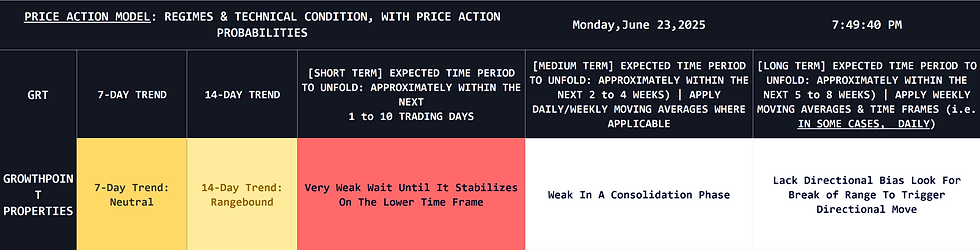

Growthpoint Properties (GRT) is currently in a state of technical indecision, trapped within a sideways consolidation phase. This lack of direction is occurring within a broader "Weak" medium-term regime, suggesting that the current price action is more likely a pause in an ongoing downtrend rather than a genuine bottoming process.

The long-term outlook is Neutral, explicitly lacking a directional bias. This reinforces the view that there is no clear technical edge for either bulls or bears at this moment. A new, sustainable trend will only be triggered by a decisive breakout from the current trading range. Until such a resolution occurs, the most prudent strategy is to remain on the sidelines and await a clearer signal from the market.

2. Visualizing the Current Trading Range

The stock is caught between two well-defined technical levels, which must be monitored closely:

Resistance (Range High): This level acts as the ceiling for the current consolidation. A decisive and high-volume breakout above this level is required to signal a bullish recovery.

Support (Range Low): This level acts as the floor. A breakdown below this support would confirm the continuation of the broader downtrend and likely lead to further downside.

The price action between these two boundaries is expected to remain choppy and directionless.

3. Property Sector: Fundamental Catalysts

The performance of Growthpoint is heavily influenced by the fundamental drivers affecting the broader South African property sector.

3.1. Bullish Catalysts (Tailwinds):

Potential Interest Rate Cuts: The listed property sector is highly sensitive to interest rates due to its capital-intensive nature. Any future rate cuts by the South African Reserve Bank (SARB) would be a significant positive catalyst, as this would lower borrowing costs and tend to increase property valuations.

Diversified Portfolio: Growthpoint's exposure to a diverse portfolio of high-quality retail, industrial, and international assets provides a degree of resilience and a stable, diversified rental income stream that can weather weakness in any single sub-sector.

3.2. Bearish Catalysts (Headwinds):

Weak Domestic Economy: This remains the primary headwind. South Africa's low-growth environment leads to higher property vacancy rates and limits the ability to implement rental escalations, particularly in the office and retail sectors.

High Interest Rates: The current "higher for longer" interest rate environment increases the cost of debt, which is a major expense for property companies. This directly and negatively impacts earnings and cash flow.

4. Dissecting the Price Action Model

The technical outlook for GRT is consistent across multiple timeframes, painting a picture of weakness and indecision:

Short-Term (1-10 Days): The trend is rated "Very Weak." The model advises waiting for the price to stabilize on the lower time frames before any bullish position can be considered. A recovery buy/long is only triggered on a confirmed break of the current range high on strong buying volume.

Medium-Term (2-4 Weeks): The trend is described as "Weak In A Consolidation Phase." There is no clear directional signal at present, reinforcing the need for patience.

Long-Term (5-8 Weeks): The outlook "Lacks Directional Bias." The model indicates that a break of the current range is required to trigger the next sustainable directional move.

5. Price Action Probabilities

Based on the current technical readings, the probabilities for the next major move are assessed as follows:

Continued Range-Bound Action (60% Probability): The most likely scenario. The stock remains trapped between support and resistance, reflecting ongoing market indecision and a balance of power between buyers and sellers.

Bearish Breakdown (25% Probability): The broader weak trend reasserts itself, causing the price to break decisively below the current range support. This would signal a continuation of the downtrend and likely lead to further downside.

Bullish Breakout (15% Probability): The least likely scenario. A significant influx of buying interest emerges, pushing the price decisively above the range high. This would invalidate the bearish thesis and trigger a recovery.

Lester Davids

Senior Investment Analyst: Unum Capital

Comments