JSE Sectors: Leaders & Laggards + Rotation

- Lester Davids

- 12 hours ago

- 1 min read

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

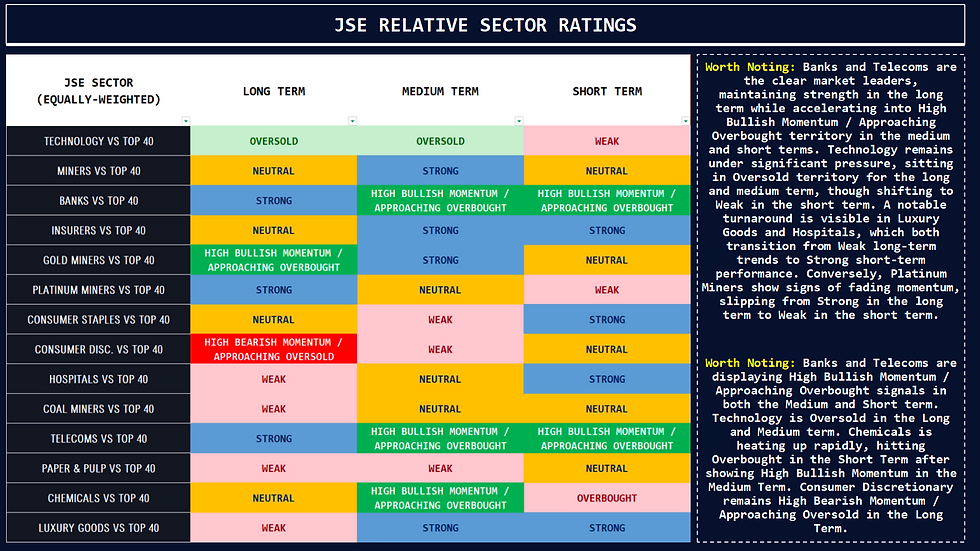

The undeniable leaders of the YTD period are the Banks and Telecommunications sectors. At the end of 2025, Banks were rated Neutral across all timeframes, painting a picture of a sector in equilibrium. Fast forward to February, and Banks have erupted into a "High Bullish" state on medium and short-term timeframes, dragging the long-term trend to "Strong." Similarly, Telecoms have transitioned from a mundane Neutral/Strong profile to "High Bullish" momentum, signaling a rush for yield and domestic infrastructure exposure. The Chemicals sector deserves special mention as the "turnaround leader"; it has executed a V-shaped recovery, moving from "High Bearish" and "Approaching Oversold" in December to "High Bullish" and "Overbought" in February, likely driven by idiosyncratic corporate action or a sharp commodity price repricing.

Conversely, the clear laggards remain Technology and Consumer Discretionary. Technology has deteriorated further, sliding from "Weak" to "Oversold" on long and medium terms without attracting any bargain hunters. It remains a dead weight against the Top 40. Consumer Discretionary is equally concerning, stuck in "High Bearish Momentum" on the long term. Unlike the Chemicals sector, which rebounded from similar lows, Discretionary stocks have failed to catch a bid, highlighting deep structural concerns regarding the South African consumer's spending power.

Lester Davids

Senior Investment Analyst: Unum Capital

Comments