S&P 500 Index | Overshoots 200-Day; Resistance Range In Focus

- Lester Davids

- May 12, 2025

- 2 min read

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

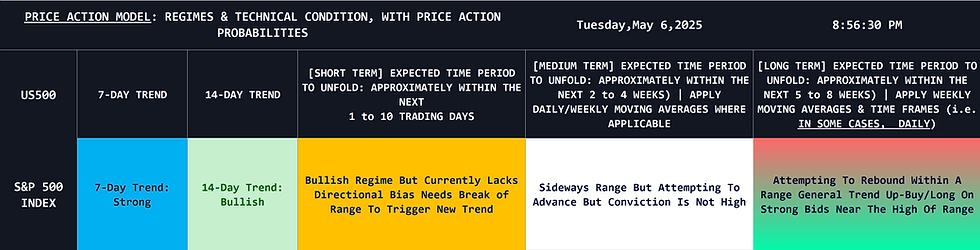

Previous Post (Tuesday, 06 May - South African Time / 20h56 / U.S Trading Session):

S&P 500 Index | Extreme Conditions Unwind; Faces 200-Day Test

Does the index offer an appealing buy/long reward-to-risk at or around current levels? No.

Can it trade higher? Yes, that's possible.

Should we be surprised if it pulls back? No

On 09 April, we highlighted the extreme reading on the 'Market Risk Index', with the indicator trading in 'extreme fear' territory i.e. opportunity. From the lows on 09 April, the S&P 500 index has rallied from ~4950 to a high of 5703 on Friday 02 May. In focus is the 200-day simple moving average which currently lacks directional bias and is a likely headwind if the index trades higher from current levels. There is always a possibility that the index reclaims the 200-day, trades above it, then fails to hold the level. Bear in mind, the index has advanced from deeply oversold on 09 April to high bullish momentum/approaching overbought on Friday 02 May.

Previous Post (09 April at 10h16 South African Time)

Market Risk Index: The Weekly Reading Is Worth Noting!

*Weekly Time Frame* - Current

*Monthly Time Frame* - Current

The indicator is a custom-built risk and sentiment index, designed to assess market risk appetite, including whether sentiment is at an extreme position (i.e. excessively bullish or excessively bearish).

Components:

Copper: Copper often serves as a proxy for global economic activity. A decline in copper prices could signal slowing economic growth, increasing risk.

High Beta vs Low Beta: High beta stocks tend to be more volatile than low beta stocks. A widening spread between high and low beta returns might indicate increased risk aversion.

Growth vs Value: Growth stocks typically outperform value stocks in bull markets. A shift towards value stocks could suggest investors are becoming more cautious.

EM Currencies: Emerging market currencies can be sensitive to risk appetite. A weakening of EM currencies could signal increased risk aversion.

AUD/USD: The Australian Dollar is often used as a proxy for global risk sentiment. A decline in AUD/USD could indicate increased risk aversion.

Consumer Staples vs Consumer Discretionary: Consumer staples are generally considered defensive assets. A shift towards consumer staples could suggest investors are seeking safety.

Semiconductors vs S&P 500: The semiconductor sector is cyclical and sensitive to economic downturns. Underperformance of semiconductors relative to the broader market could signal increased risk.

Russell 2000 ETF: This ETF tracks small-cap stocks, which are generally considered riskier than large-cap stocks. Underperformance of the Russell 2000 could suggest increased risk aversion.

U.S. Dollar Index (Inverse): A strengthening US Dollar often signals a flight to safety, suggesting increased risk aversion.

Comments