JSE Sectors: Wakey, Wakey...

- Lester Davids

- 20 hours ago

- 1 min read

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

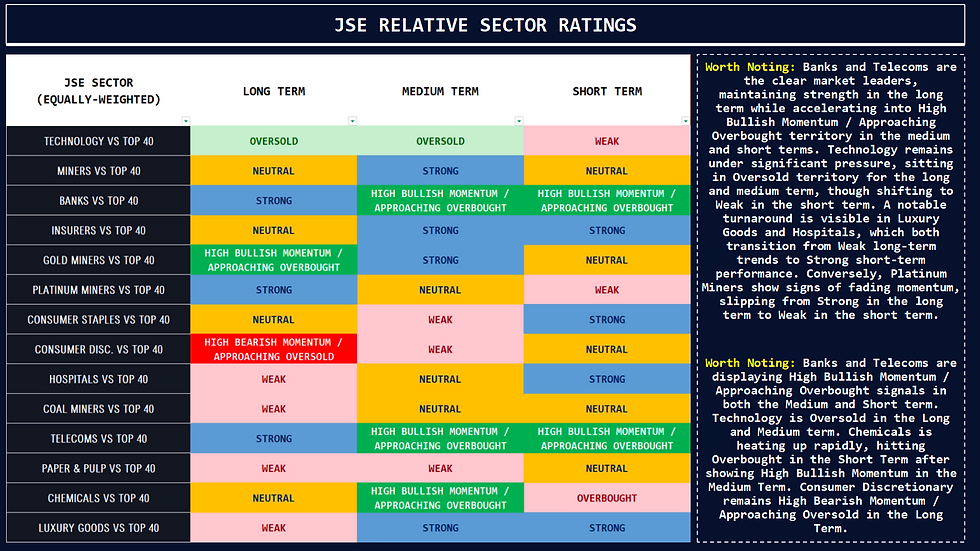

Looking beyond the obvious breakouts, the Luxury Goods and Insurers sectors are clearly "waking up." Luxury Goods ended 2025 with a Weak long-term signal, but the February data shows a pivot to "Strong" in the medium and short terms. This implies that while the mass-market consumer is struggling, the high-end consumer—or the export-facing luxury market—is finding renewed vigor. Insurers are following the Banks' lead, improving from a "Weak" long-term posture to "Neutral," while their shorter-term signals have turned "Strong," confirming a broad-based rotation into the financial complex.

On the "fading" side, Platinum Miners show worrying signs of exhaustion. While they retain their long-term "Strong" rating, the short-term signal has degraded from "Strong" in December to "Weak" in February, with the medium-term dropping to "Neutral." This loss of momentum suggests that the platinum trade has become crowded and is now a source of funds for the rotation into financials. Paper & Pulp also continues to fade; the "Oversold" signal in December failed to catalyze a bounce, and the sector has simply drifted into a "Weak" rating, indicating a value trap rather than a value opportunity.

Lester Davids

Senior Investment Analyst: Unum Capital

Comments