USD/ZAR: Risk Aversion + USD Strength Pushes The Pair Back Above R18.00 (In Line With Model)

- Lester Davids

- Jun 23, 2025

- 1 min read

Research Notes For 23 to 27 June > https://www.unum.capital/post/r2327june

Trade Local & Global Financial Markets with Unum Capital.

To get started, email tradingdesk@unum.co.za

Previous Post (15 May): USD/ZAR: Reward-To-Risk Becoming Attractive For A Small Buy/Long Position

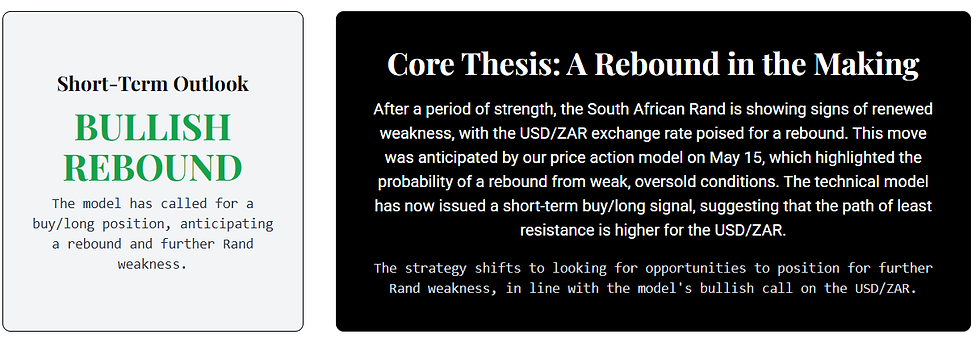

This is a further on the previous post which considered the potential for a small rebound. We saw this occur as the pair traded from R18.20 to R18.46. As also previously noted, the level down to APPROXIMATELY R17.99 was a key level of interest.

Previous Post (06 May) USD/ZAR: Approaching Oversold + Probability of a Small Rebound

Please see the price action model + the chart below.

{Chart: Full Screen}

The slide below is from our research report 'The Sum of the Charts' for Monday, 05 May 2025.

Previous Post (Monday, 05 May): The Rand Has Advanced In Line With The Model Reading

In 07 April, we published a note, highlighting the poor buy/long reward-to-risk with the best probability for the price action model over the subsequent 2 to 4 weeks being a consolidation or minor retracement. We have since seen the pair retrace sharply, from R19.38 to R18.26.

Previous Post: USD/ZAR: Ultra Short Term Sees Poor Buy/Long Reward-To-Risk

Current price action model reading + updated chart. We saw the share temporarily hold the the R18.23 to R18.36 zone before trading lower, then reclaiming it for a rally to the current multi-week highs nears R19.44.

Lester Davids

Analyst: Unum Capital

Comments