top of page

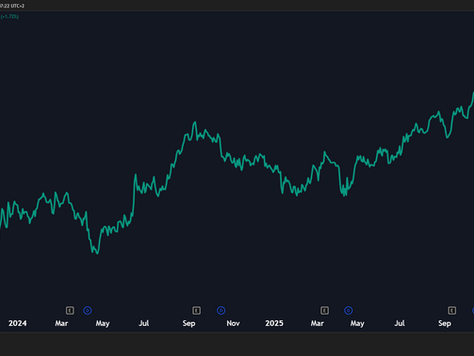

British American Tobacco: Consolidating For Continuation

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Previous Post (August 2025): British American Tobacco: Running +95% in 21 Months + All Time High (Above R1000) The extract below is from a note to clients on Wednesday, 06 December 2023 at 53198c, highlighting both a manual view (channel) as well as the price action model reading. Within just under 21

Lester Davids

Feb 1

Trading Spot Gold: Buy Re-Entry Range

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

Feb 1

Harmony Gold (HMY): Full Target Reached at $26.00. Next Best Probability Trading Ranges

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za For our clients trading Harmony Gold (HMY) in New York. Update: Harmony Gold (HMY) reached the full target range of $24.00 to $26.00 (high of $26.06). BUY/LONG RE-ENTRY THESIS: The moving averages remain positively stacked (i.e. 8-day EMA > 21-day EMA > 8-Week EMA > 75-day EMA > 21-Week EMA). On this

Lester Davids

Feb 1

Actionable Trading Levels: Impala Platinum

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za BUY/LONG RE-ENTRY THESIS: The moving averages remain positively stacked (i.e. 8-day EMA > 21-day EMA > 8-Week EMA > 75-day EMA > 21-Week EMA). On this basis, a deeper pullback is likely to be bought for an ultra short term rebound. SELL/SHORT RE-ENTRY THESIS: Rebounds are likely to be capped by th

Lester Davids

Feb 1

Actionable Trading Levels: Sibanye Stillwater

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za It's worth bearing in mind that the share is higher by just under 500% from our 28 February 2025 note (LONG TERM CYCLE READY TO UNFOLD) there it makes no sense recommending brand new aggressive buy/long entries at current levels. The question for short and medium term traders is: On a deeper pullback,

Lester Davids

Feb 1

JSE Top 40 Index: Target Reached + Bearish Reversal. See Updated Comment & Chart

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za The index reached the 118,000 to 120,000 target range (high of 119,314 on Thursday). The weekly candle (as of Friday 30 January at 15h22) reflects exhaustion from extreme overbought levels. Expect some consolidation in the next couple of weeks. Previous Post: Trading JSSE Top 40 Index Date: Sunday, 25 J

Lester Davids

Jan 30

JSE Share: Down Nearly 10%; In Line With Price Action Model

Research Notes January 2026 > https://www.unum.capital/post/rjan2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Update: Bearish Reversal in line with price action model (see original note further below): Down nearly 10% today. Previous Post (Tuesday 27 January, After Market Close):🎥Video: Valterra Platinum This post was meant to to be published yesterday evening (Tuesday, 27 January) unfortunately a personal err

Lester Davids

Jan 30

Buy Continuation (Monthly) 🟢

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Reward-To-Risk Profiles: Monthly Time Frame

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za The data is subject to change based on the subsequent news flow and price action. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Trading Glencore Plc: Reduce Into This Overextension

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Glencore Plc (GLN) has performed well, driven by strong commodity prices as well as corporate action (Rio Tinto merger). The share was first triggered on the back of the price action model reading which looked for a tactical rebound. This saw a sharp bullish reversal and strong upside follow-through a

Lester Davids

Jan 30

Trading Kumba Iron Ore: Approaching R386/R396 Target

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Kumba Iron Ore (KIO) is inching close to our target of R386-R396. The share has gradually trended higher from out 18 June buy trigger at R274, reaching a high of R382 on Thursday 29 January. Buy/Add on Pullback. Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active t

Lester Davids

Jan 30

Trading BHP Group: Medium Term Traders Consider Reducing Into Strength (Currently Running +40%)

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za Trading Notes/Resources (Where Applicable) READY TO TRADE: ACTIONABLE AREAS: For active traders who look to generate cash flow on a continuous basis, determining the ‘next best probability’ level to execute against may be of immense value. The blue and red horizontal lines on the chart represent a

Lester Davids

Jan 30

Buy On Pullback (Monthly)🟢

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Approaching Sell/Reduce (Monthly)🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Approaching Buy/Add (Monthly)🟢

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Market Internals: Breadth, Factors and Positioning

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za The data is based on the monthly time frame and is subject to change based on the subsequent news flow and price action. Breadth & Participation 📊 Bank Uniformity: Every major bank (SBK, NED, FSR, ABG, INL) is in the Leading phase, but 60% have hit "Sell/Reduce" or "Wait" zones, signaling sector-wid

Lester Davids

Jan 30

Sell Continuation (Monthly)🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Sell On Rally (Monthly)🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Materials: Momentum Dashboard (Monthly) 🟢🟡🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

Retail: Momentum Dashboard (Monthly) 🟢🟡🔴

Research Notes February 2026 > https://www.unum.capital/post/rfeb2026 Trade Local & Global Financial Markets with Unum Capital. To get started, email tradingdesk@unum.co.za THE DATA IS SUBJECT TO CHANGE AS THE NEWS FLOW AND PRICE ACTION DEVELOPS. Lester Davids Senior Investment Analyst: Unum Capital

Lester Davids

Jan 30

bottom of page