Notable

- Lester Davids

- Jan 22, 2024

- 16 min read

Updated: Feb 6, 2024

Notable is a page dedicated to fast-paced, running research commentary intended to alert to client to a potentially significant level or development, mainly from a technical perspective. Furthermore, the content gives clients access to the analyst's perspective of an instrument which can help in preparing for a potential trading opportunity.

The research insights below represent my views thus far today. Additional insights may be added where applicable.

To trade, or open a new account, contact the Unum Capital Trading Desk:

E-mail: tradingdesk@unum.co.za | Call: 011 384 2923

Lester Davids

Analyst: Unum Capital

➡️ Tuesday 06-February-2024, 08h54 | BKNG Booking Holdings ($3625) | The consolidation and positive candle structure at multi-month highs may support the start of a pre-earnings advance and the break out of the range to the upside. Booking Holdings is the world’s leading provider of online travel and related services. To view the chart, click here => https://www.tradingview.com/x/GmaGgmvp/

➡️ Tuesday 06-February-2024, 06h52 | Offshore | Palantir Technologies (PLTR) reported results overnight, surging by 17% in after-hours trade / Ferrari (RACE) - which was also highlighted separately as a trade idea, reached €360 from €315 at the time of being highlighted (+14%) / DraftKings (DKNG) is higher by 24% since being highlighted / Thales (HO), which is listed on France's CAC 40 Index traded higher to test €142before retracing, with the last close at €134.95.

Below are the original charts, which were highlighted on the telegram group (09-Jan) and on the website (10-Jan)

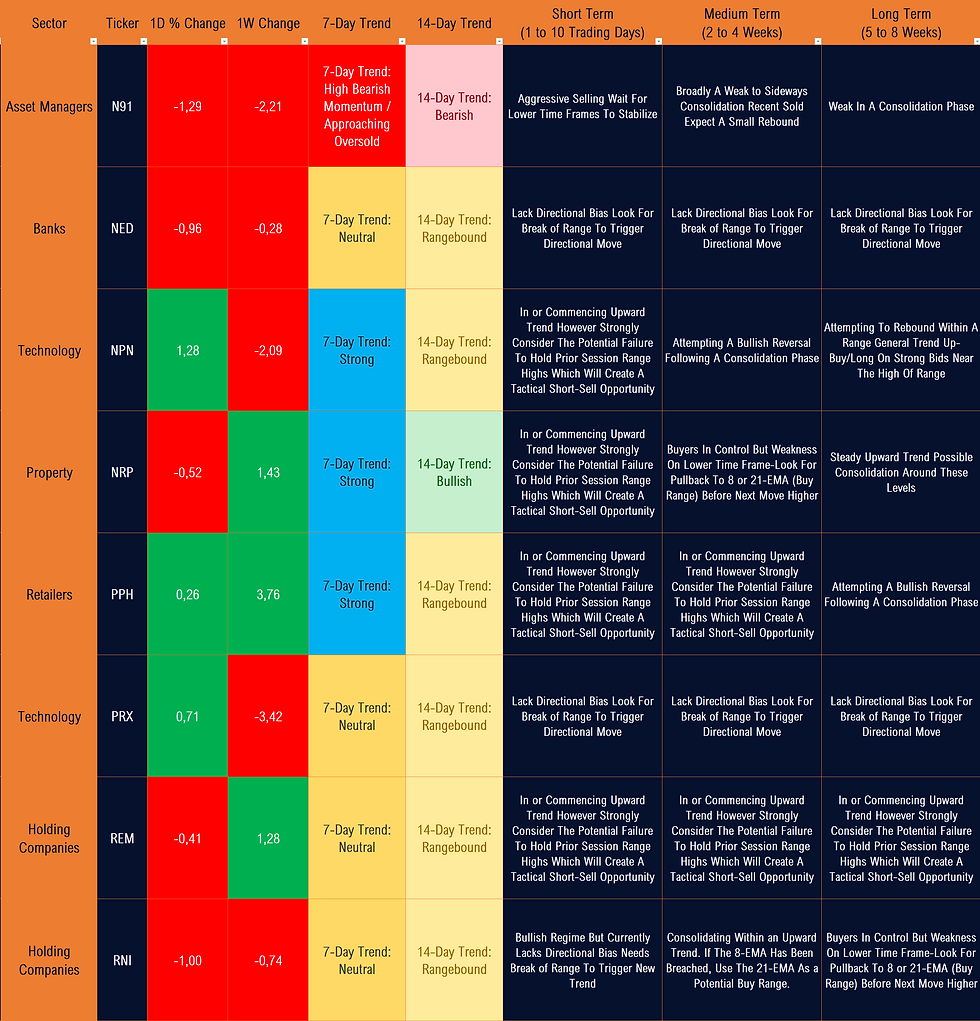

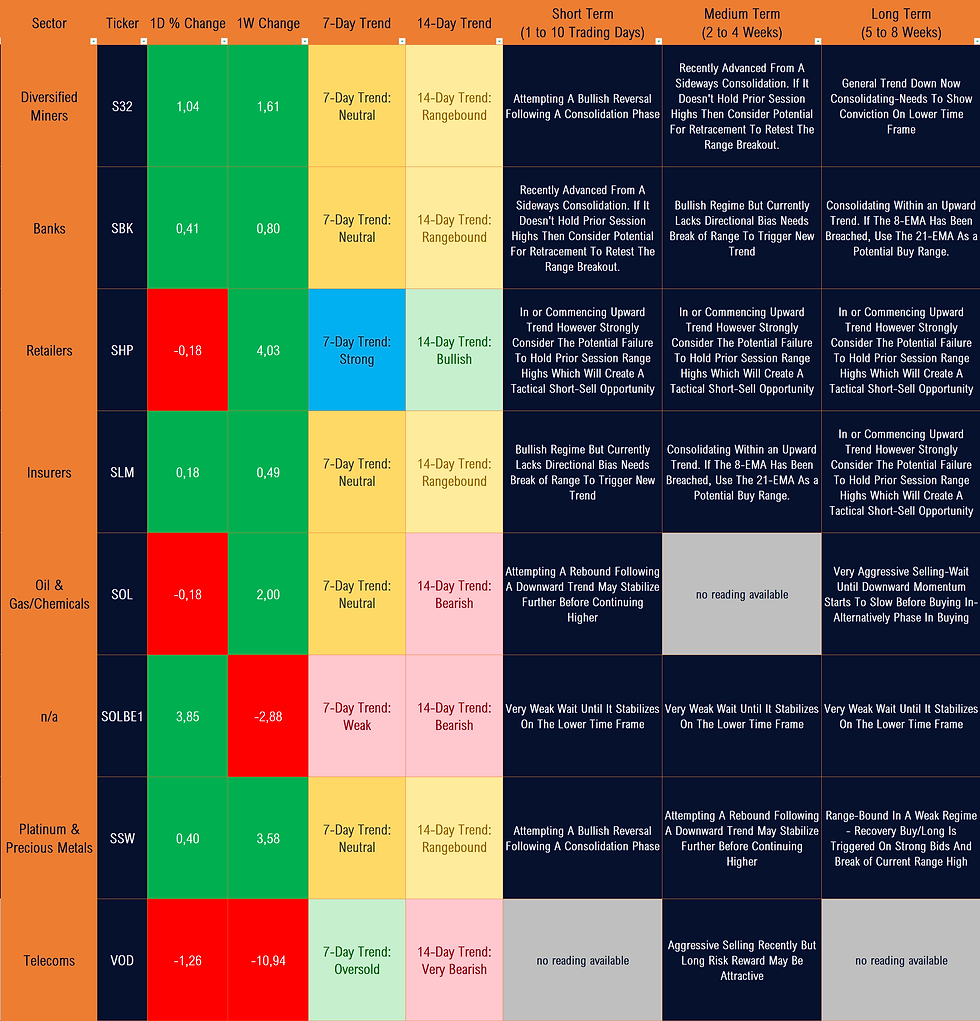

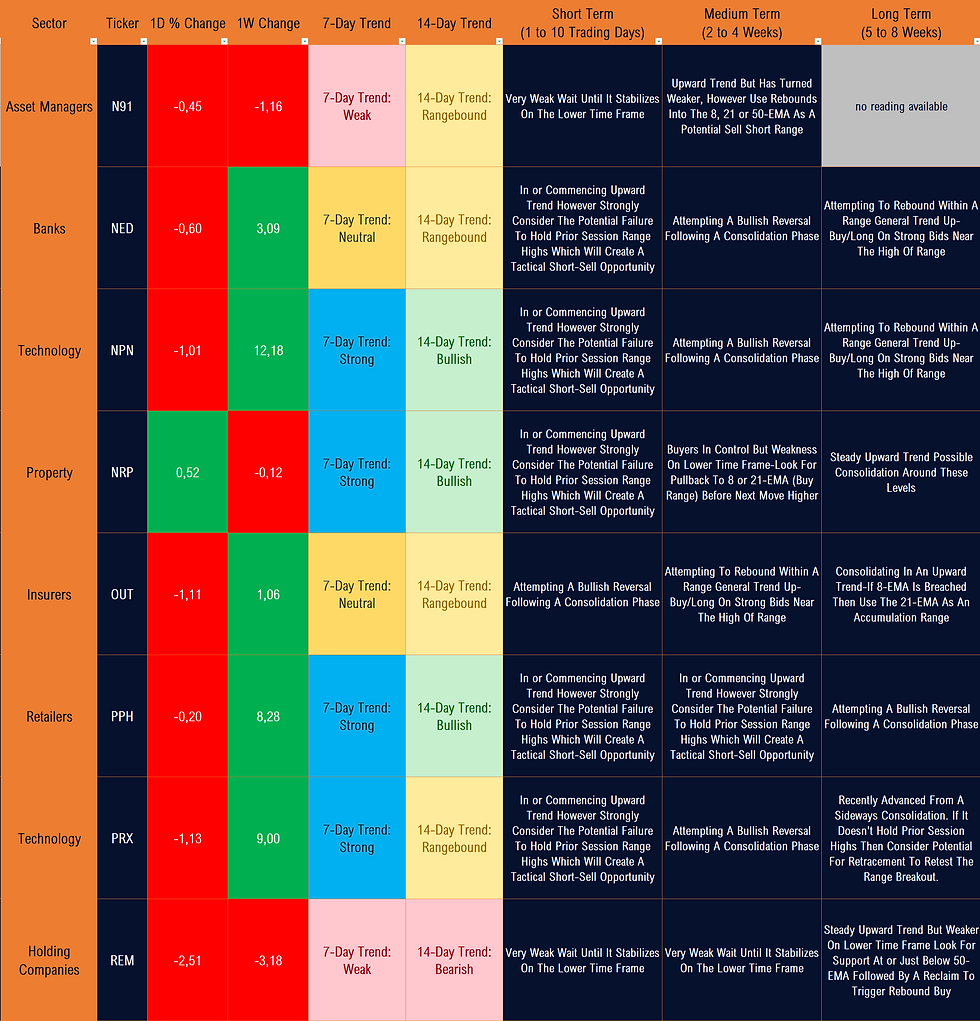

➡️ Tuesday 06-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

➡️ Tuesday 06-February-2024, 06h30 | SLM Sanlam Ltd | Potential upside continuation trade should we see improving candle structure. Gradual upward trend, with relative strength versus the broader market.

➡️ Tuesday 06-February-2024, 06h30 | CPI Capitec Bank | The share has been consolidating at all-time highs, with a sideways trading range having developed since November. While tactical, ultra short term opportunities have developed, the broader structure remains bullish, with the price trading above it's 200-day SMA (and not overly extended) as well as above it's 50/100-day EMA range. Strong price action, with a print above R2055 could be a 'technical catalyst' for further upside momentum. Laos note yesterday's above-average volume. Clients were alerted to a medium term opportunity in Capitec Bank in May 2023 near R1320, with the weekly chart structure presented at the time - the original chart is also shown below. (The structure is similar to BID Corp in recent weeks).

CPI as of yesterday's close:

CPI Capitec Bank (Weekly Chart) as presented to clients in May 2023

➡️ Tuesday 06-February-2024, 06h30 | BVT Bidvest Group | I have been bearish on Bidvest since mid-August when the share traded around R270 (view published to clients - see original chart below), with the price eventually trading above R290 before reversing it's gains. The bearish structure looks set to continue with the following noted: (1) price below the 200-day SMA (2) price below the 50/100-EMA range (3) bearish MACD cross below the centre line (4) pending breach of incline support.

➡️ Tuesday 06-February-2024, 06h30 | SNPS Synopsys | In The Money (+8%) / Approaching Target / 6-Week High

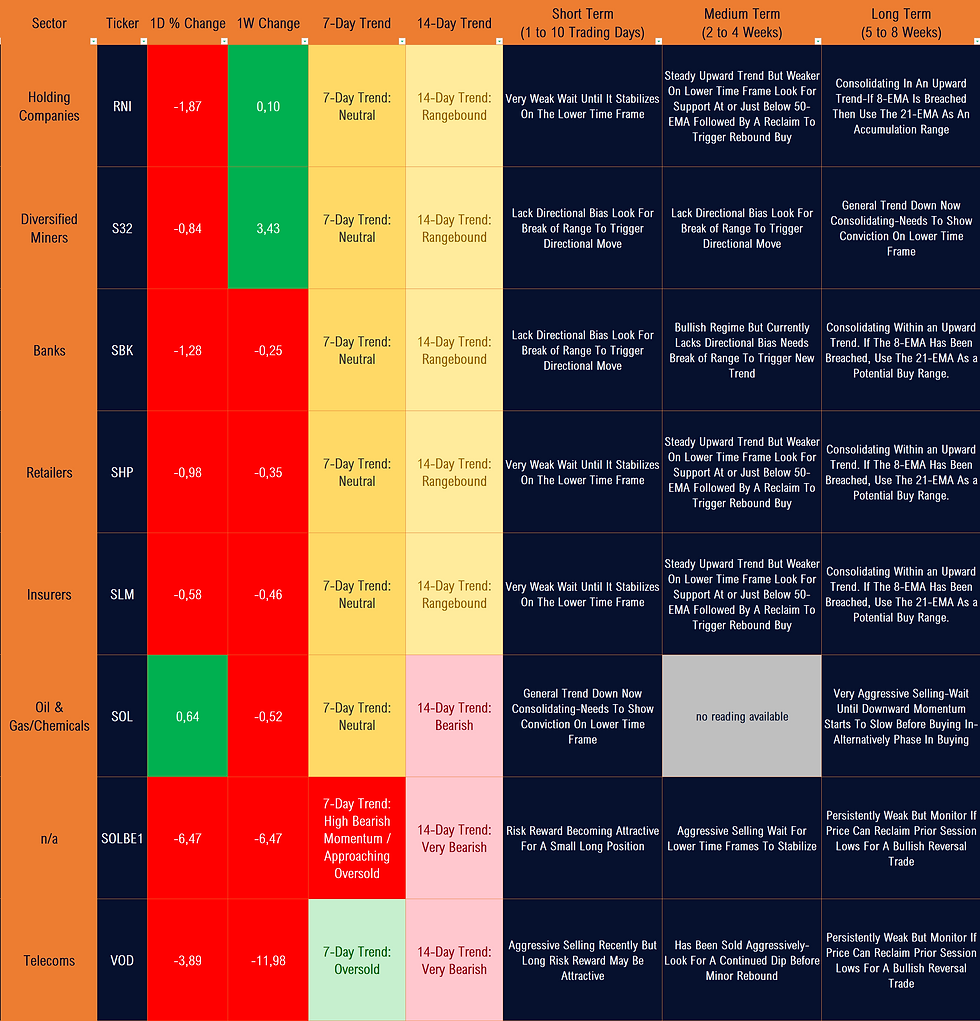

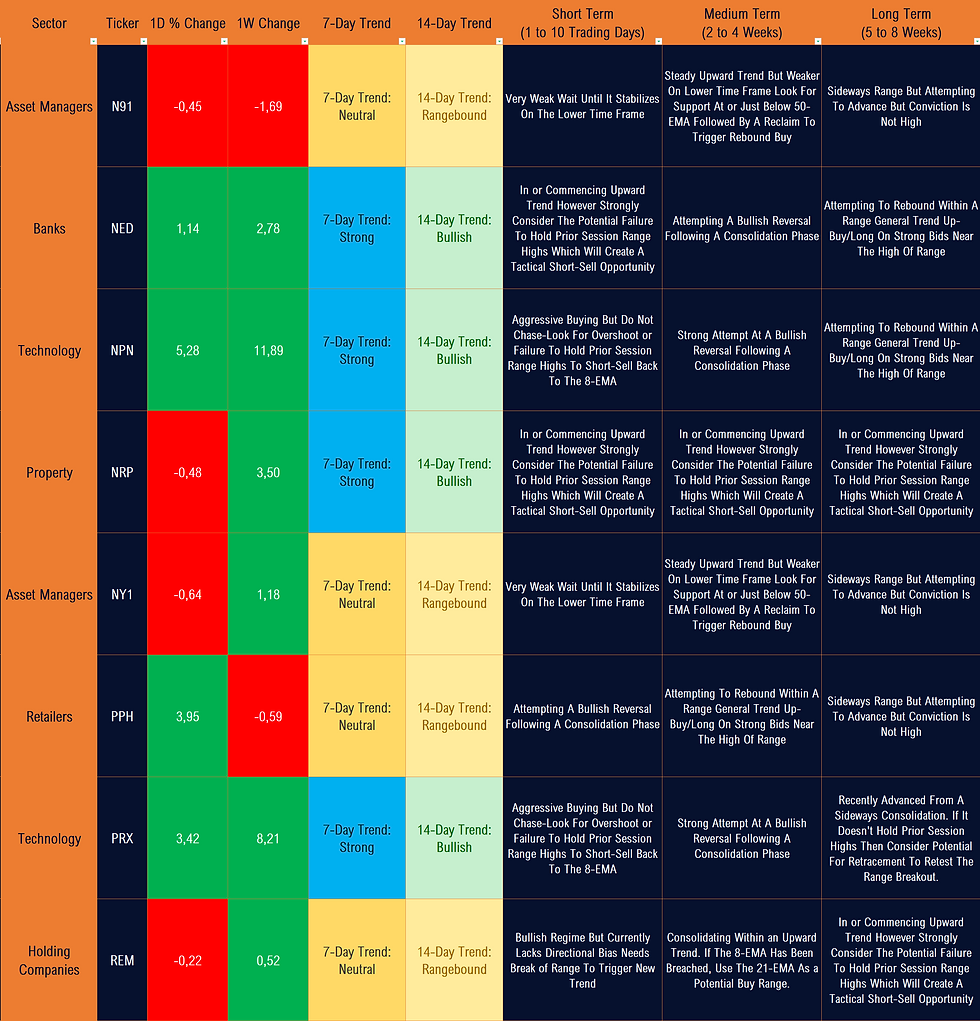

➡️ Tuesday 06-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

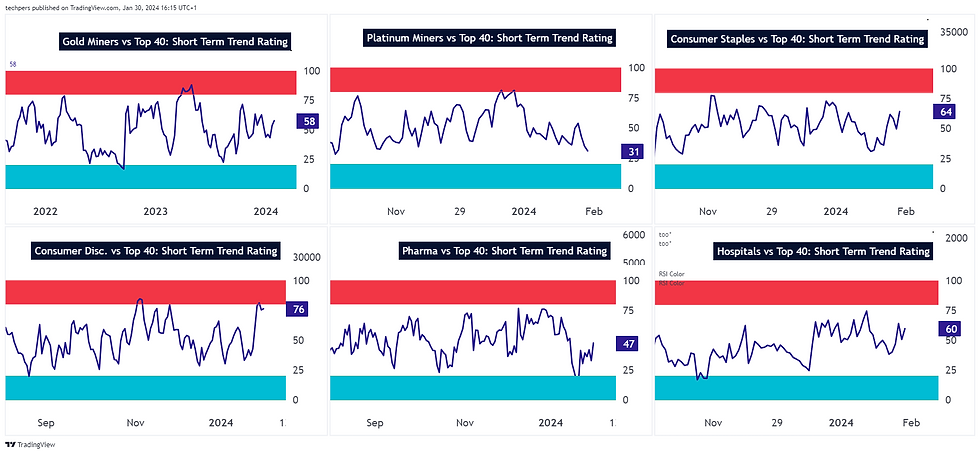

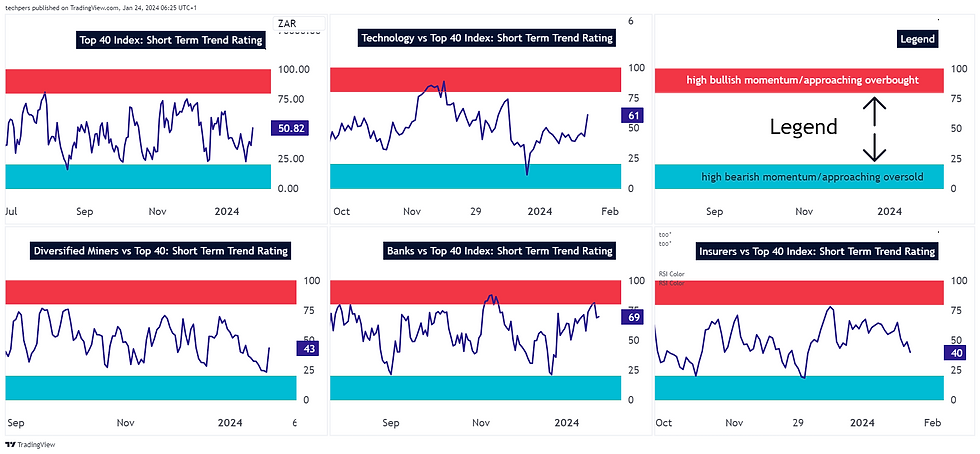

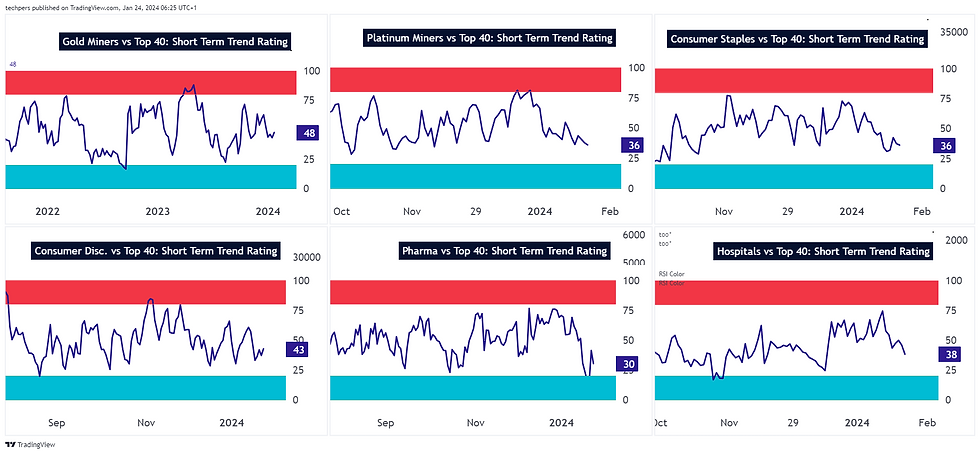

➡️ Tuesday 06 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

➡️ Monday 05-February-2024, 06h30 | TALKING POINTS | January payrolls data (353k vs 185k expected) dial back expectations for a March interest rate cut | US Dollar & Interest Rates Surge | S&P 500 Closes At Record High | Consumer Staples Show Relative Strength (In Line With Late December Screens) | Selected Technology Shares Rally Amid Strong Earnings | EM Currencies Weaker As USD Gets Bid | Utilities & Real Estate Underperform On Higher Yields | JSE Gold Shares Reverse Gain From Short Term Overbought Conditions.

➡️ Monday 05-February-2024, 06h30 | S&P 500: Stats Underneath The Surface

Record Highs, However, Here Are Some Statistics To Consider:

➛ Only 64% of shares are trading above their 50-day moving average versus 91% on 02-January. This is a bearish divergence.

➛ Only 70% of shares are trading above their 200-day moving average versus 78% on 02-January. This is a bearish divergence.

➛ The Equity Risk Premium is at it's lowest level since 2021

➛ The percentage of shares with RISING moving averages is starting to roll over.

➡️ Monday 05-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of Friday's close.

➡️ Monday 05-February-2024, 06h30 | Strategy Screen (Medium Term 2 to 4 weeks): | Kumba Iron Ore (KIO) and Standard Bank (SBK) | "Attempting to rebound with a range. Buy/long on strong bids near the highs of the range" . *A strategy screen is a filter derived from my Tactical Trading Guide which aims to highlight a share's technical position or groups certain shares according to their technical reading on the same time frame. The readings are subject to change, based on the subsequent price action/price development. The tickers are highlighted in the column to the far left.

➡️ Monday 05-February-2024, 06h30 | BID Bid Corp | The share reached an all-time high on Friday with a print of 47807c. The positive price action development is welcomed considering that clients were alerted to the potential for new highs on 09 January at a price of 41598c (pre-market). Friday's pre-market technical rating for the share showed an OVERBOUGHT condition (see Friday's technical summary), with the Tactical Trading Guide also stating the following for the short term: "Aggressive buying but overbought on the lower time frame. Expect a consolidation or a minor retracement". Friday's candle structure may be reflective of this reading with a 'dark cloud cover' candle formation being printed by the close of the session. Bottom Line: Following the expansive move from 41598c (+14.9%), the buy/long reward-to-risk is less favourable.

Monday 05-February-2024, 06h30 | MNP Mondi Plc | The unwind from overbought conditions has continued, with the share reaching it's lowest level since 29 November. The 8 and 21-EMA has been breached to the downside while both of these Exponential Moving Averages have started to turn lower. Also note that support of the 50-EMA has been lost. What's Next? The next first level of support is the 200-day Simple Moving Average (SMA) which is situated at around 31486c at the Friday's close. This level is also in line with the previous consolidation zone which developed in the second half of the month of November.

Monday 05-February-2024, 06h30 | LHC Life Healthcare | Failure To Follow Through (Approaching Stop-Loss). The buy/long trade idea hasn't lived up to expectations, with the share having rolled over in recent sessions.

Monday 05-February-2024, 06h30 | SAP Sappi | Buy/Long Target Exceeded As JP Morgan Upgrades To Overweight (OW).

Monday 05-February-2024, 06h30 | GFI Gold Gold Fields | The share is +30% from R227/228 buy level (discussed on the telegram group on 10 January). On Thursday and Friday the share traded in an OVERBOUGHT range (see previous days' technical summary) which meant that the reward-to-risk was less appealing that seen at lower levels. Friday we saw a classic 'gap fill' and retrace on the back of a strong USD (due to non-farm payrolls) which resulted in a pull in the price of Gold. Friday's pre-market The Tactical Trading Guide also stated the following: "Very strong move, buyers in control, but don not chase (i.e. buy at current levels). The share may fail at an attempt to hold it's previous session highs which would be an opportunity to sell/short back to the 8-EMA".

My next level of interest is the 21/50-EMA (currently around R261-R263).

Monday 05-February-2024, 06h30 | US Trucking Stocks | The sector has been appearing on my screeners since mid-December which was a the reason why I published a buy/long idea on SAIA (now up more than $100 from $426 to $543 (+25% over the 6 weeks). In addition, the setup on Old Dominion Freight Lines (ODFL) continues to appear attractive while JBHT (JB Hunt) is showing strength at the upper range of it's consolidation range.

JB Hunt Transport (JBHT) - Market Cap: $21bn - Buy/Long Candidate

Monday 05-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Monday 05 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Friday 02-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

Friday 02-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Friday 02 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Thursday 01-February-2024, 14h25 | RACE Ferrari: Update. This morning the group reported it's results for the full year and fourth quarter. Today the share is higher by over 5.5% and is apporaching the technical target.

Thursday 01-February-2024, 13h46 | TRU Truworths: This morning TRU was in the overbought category and on an intraday basis, is failing to hold it's prior session high range. Note that it's also trading at the upper boundary of it's 50-day standard deviation linear regression channel. Reduce buy/long risk.

Thursday 01-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

Thursday 01-February-2024, 06h30 | REM Remgro: Strong candle structure (also closing above the 5-day range highs), on volume. Bias: Buy/Long.

Thursday 01-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Thursday 01 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Wednesday 31-January-2024, 16h20 | Invesco QQQ Trust (QQQ) | Pre-market weakness in technology stocks will see the ETF open lower (below the 8-EMA but above the rising 21-EMA). The 21-EMA is also in line with the previous breakout level and could act as a tactical support zone for active traders looking to take advantage of near term weakness. The primary trend remains up with the price above it's rising 21 and 50-EMA however, the distance versus the 200-day SMA is a medium term concern.

Wednesday 31-January-2024, 14h44 | CFR Richemont | The share has seen a sharp rally following the 'piercing candle' setup which was highlighted in the short term oversold range. Today we seeing the development of a bearish engulfing candle formation which was developed within an overbought range. This may signal a slowdown in the short term upward momentum with a retracement back to the previous breakout level or to the mid-point of the 8-21 EMA. The R2660 range is a likely re-entry for active traders looking to buy on the pullback.

Wednesday 31-January-2024, 10h32 | GFI Gold Fields | The share is failing to hold yesterday's highs, with today's weakness being in line with the reading as per the pre-market Tactical Trading Guide. The share remains above the 8-day EMA which could provide a short term level of support.

Wednesday 31-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

Wednesday 31-January-2024, 06h30 | Strategy Screen: Montauk Renewables (MKR) and Sasol (SOL). *A strategy screen is a filter derived from my Tactical Trading Guide which aims to highlight a share's technical position or groups certain shares according to their technical reading on the same time frame. The readings are subject to change, based on the subsequent price action/price development.

Wednesday 31-January-2024, 06h30 | DSY Discovery Holdings | Strong reversal + short term upside follow-through with the share reaching an intraday high of 14300c from the signal at 13279c (+7.6%). Two signals at the time: (1) doji candle formation + buy signal via the Tactical Trading Guide (shown below). Well done to all who traded it. The original and follow-up charts are shown below:

Wednesday 31-January-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Wednesday 31 January 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Tuesday 30-January-2024, 15h49 | S&P 500 Index Future (ES1) | Two items to note: (1) trading at the upper boundary of a multi-month channel (could encounter resistance) + (2) analyzing the multi-time frame regimes, I note that the index is nearing overbought conditions on multiple time frames.

Tuesday 30-January-2024, 13h29 | OMU Old Mutual Strong candle structure at the upper boundary of a short term trading range. Buy/Long Trigger +1235c.

Tuesday 30-January-2024, 13h13 | ANH Anheuser Busch-Inbev | My last idea on the share was a buy/long on 06 July at R1065. The recent high was R1237 on 11 January (+16% ungeared). At current levels, the share may be setting up for higher levels with the price potentially emerging from a consolidation range.

Tuesday 30-January-2024, 12h49 | Ferrari (RACE): Buy/Long Setup on trigger.

Tuesday 30-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

Tuesday 30-January-2024, 06h30 | CPI Capitec Bank | Most recently I published a sell idea however, the share traded higher, testing the stop-loss. We may now be starting to see weakness emerging. The share is trading at the mid-point of it's 200-day linear regression channel. The bearish divergence is being reflected via the share price which has started to weaken while the bearish MACD crossover supports a potential bearish reversal. Also note the short term trend line support at risk. A breach of this level could see the share test the lower boundary of the linear regression channel (around R1820).

Tuesday 30-January-2024, 06h30 | HAR Harmony Gold | A 'TAKE NOTE' CANDLE. Yesterday's pre-market reading for the share is shown below. The short term (1-10 day reading) stated that buying has been aggressive and that it is overbought on the lower time frame. It also states that traders should expect a consolidation or a minor retracement. By the end of the day, the candle reflected sellers taking control of the session.

Tuesday 30-January-2024, 06h30 | Standard Deviation | 3 Shares That Are Trading At the Lower Boundary Of Their 50-Day Linear Regression Channels: MCG, MTN, VOD

Tuesday 30-January-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Tuesday 30 January 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Monday 29-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of Friday's close

Monday 29-January-2024, 06h30 | Insurers: Tight Consolidations In MTM and SLM | "From contraction comes expansion" - is this what we'll see in MTM and SLM? Both names have been in a gradual upward trend and are consolidating just below 52-week highs. To support a potential move higher, positive candle structure would have to be maintained, combined with elevated volume and a break of the range highs.

Monday 29-January-2024, 06h30 | ABG Absa Group | My goal is to identify and convey the most relevant information that will lead to actionable opportunities. While I do publish the Tactical Trading Guide, there are times when a reading is worth highlighting due to the significance of the opportunity at hand. On 11 December, the reading for Absa Group pointed to a potential buy, with all three time frames being in favour of a near term rebound. The readings at the time are shown in the image below. We have since seen the share find a base and on Friday, print a massive candle which may be reflecting strong buying interest.

Reading from Tactical Trading Guide for 11 December (ABG)

ABG Chart as of Friday's close: Strong follow-through since the above signals on 11-December.

Monday 29-January-2024, 06h30 | CFR Richemont | The strong rally off the channel support continues as the luxury sector sees 'green shoots'. After a +24% rally, the short term reward-to-risk does not appear to favour buyers. The reading from the Tactical Trading Guide as of Friday's close is shown below:

Monday 29-January-2024, 06h30 | Piercing Candles With Strong Bullish Reversals | On 17-January I pointed out very appealing technical setups in CFR, BHG, TFG and KIO. We have subsequently seen strong bullish reversals for these piercing candle formations. Below are the original charts, followed by the chart at Friday's close. Well done all who traded these setups.

CFR, KIO, TFG, BHG Original Charts - 17 January.

CFR, KIO, TFG, BHG Follow-up charts as of Friday's close.

Monday 29-January-2024, 06h30 | Strategy Screen: AIL and LHC (Long Term 5 to 8 Weeks). *A strategy screen is a filter derived from my Tactical Trading Guide which aims to highlight a share's technical position or groups certain shares according to their technical reading on the same time frame. The readings are subject to change, based on the subsequent price action/price development.

Monday 29-January-2024, 06h30 | Brent Crude Oil is higher by $9 or +11% since adding back risk on 07 December. Points 1, 2 and 3 denotes my commentary around the commodity: (1) add risk, (2) reduce risk and (3) add risk. My comment as per the telegram group is shown below, followed by the updated chart.

Monday 29-January-2024, 06h30 | Sticking with energy, three offshore names that I published on Friday pre-market were Energy Transfer (ET), Western Midstream Partners (WES) and Valero Energy (VLO). All three coming via a custom technical screener.

Monday 29-January-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Monday 29 January 2024, 06h30 | JSE Relative Sector Regimes, as of Friday's close.

Friday 26-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close

Friday 26-January-2024, 06h30 | TRU Truworths | UPDATE: The share traded into my provisional support zone, finding buyers, followed by a strong bullish reversal from 6697c to 7570c (+13% ungeared). The original and follow-up charts are shown below:

Friday 26-January-2024, 06h30 | MRP Mr Price | The recent reading is another example of how useful the Tactical Trading Guide continues to be, with upside follow-through and a massive rally. I only returned to work on Friday 05 January however having reviewed the Tactical Trading Guide for the previous day (Thursday, 04 January), the reading was as follows: "Broadly a weak to sideways consolidation. The share has recently been sold. Expect a small rebound." The timestamped reading from the TTG is shown below, with the marking reflected on the chart. In case you missed it, the following article highlights actual examples from the Tactical Trading Guide. Click Here To Read It:

Friday 26-January-2024, 06h30 | Vodacom | Yesterday the share traded close to the R90 target I discussed on Monday 15 May 2023. The original slide from the is shown below.

Previously, I published VOD as a sell above R120 (22 March 2023)

Friday 26-January-2024, 06h30 | MNP Mondi Plc | The share has rebounded strongly, testing a high of R350 during yesterday's session. On Monday 15 January I present R327 to R331 as a provisional buying level, a which the share tested during Wednesday's session. The original and follow-up charts are shown below:

Friday 26-January-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Friday 26 January 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Thursday 25-January-2024, 07h31 | Talking Points | China-related equities continuing it's bullish reversal following the stimulus announcement | MONEY FLOW: Selected non-China related equities (both ZAR hedge and local) seeing muted price action on relative basis | Clothing retailers rebound from short term oversold levels (WHL +4% in line with yesterday's pre-market tactical trading guide (short term) | MRP Mr Price has released it's trading update this morning for the 13 weeks ended 30-Dec. At the top line, Group retail sales grew 9.9% to R13.2bn and comparable store sales increased by 4.1%.

Thursday 25-January-2024, 07h11 | Coronation Fund Managers (CML): Strong price action around support. Also see the medium term (2 to 4 weeks) and long term (5 to 8 weeks) trading time frame readings.

Thursday 25-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close

Thursday 25-January-2024, 06h30 | AMS Anglo American Platinum | Strong candle structure to close near the highs of a six-day trading range + above-average volume. Needs to hold the range highs near R850 for further upside reversal potential.

Thursday 25-January-2024, 06h30 | APN Aspen Pharmacare | Year-to-date, the Tactical Trading Guide reflected that APN was overbought on the medium and long term TRADING time frames. In recent days the share has been unwinding from overbought levels with the prior breakout level is the provisional focus range. Note that this range (R179 to R181) is also in line with the gradually 200-day moving average which could offer a level of short term support. Trading levels are subject to change as the price action develops.

Thursday 25-January-2024, 06h30 | GFI Goldfields | One of the benefits of being a client of Unum capital is that you are able to obtain real-time views on market developments. On 10-January we discussed opportunities in the mining space, with GFI being one of the opportunities at the time. From ~R227, we have seen the share rally to test a high of R266 during yesterday's session (a 17% ungeared gain). Now, the gap at 26949c has been closed, with the share remaining string but likely to retrace some of the recent strong move. The Tactical Trading Guide which highlights the 3 major time frames is shown below, followed by the updated chart.

Thursday 25 January 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Thursday 25-January-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap.

Wednesday 24-January-2024, 07h41 | BHP Group: Update. Strong jump for the share on the back of the news around Chinese government intervention. Closed at the highs of the day (58797c). Late last week I set a buy level of R560 to R575. The reading from the Tactical Trading Guide as of yesterday's close is shown below, followed by the updated chart.

Wednesday 24-January-2024, 06h30 | Impala Platinum (IMP) | The share has traded into the 'first' provisional accumulation zone, with positive price action by the close of yesterday's session. Note the short term reading via the Tactical Trading Guide (1 to 10 days).

Wednesday 24-January-2024, 06h30 | Anglo American Plc (AGL)

Wednesday 24-January-2024, 06h30 | Woolworths Holdings (WHL) | Where To Buy It Next? Back in August I took the view that WHL was overbought, highlighting the extension above it's 200-week moving average. From near it's peak, with a print of 7789c at the time, the share has come under pressure, with a gradual unwind from those overbought levels. Yesterday the share tested it's lowest level since June with a low of 6347c and a close of 6496c. While oversold conditions are present, lower levels could be at hand with the R58 to R60 being the next level of interest for buyers.

Wednesday 24-January-2024, 06h30 | Truworths International Ltd (TRU) | UPDATE: Sticking with the retail theme, TRU reached it's lowest level since August with a print of 6697c, a decline of 18% from the sell/short idea on 06 November. Well done to all who traded this idea.

Wednesday 24-January-2024, 06h30 | Thungela Resources (TGA) | The share has offered opportunities on both the buy/long and sell/short side. I marked R186 to R190 as a resistance range while subsequently publishing a buy/long long on 08-Nov at 15234c (target later reached at 16400c). Current View: The share is down at a familiar level of support, that being ~12500c, which was where buyers stepped up in May and August last year. Click Here To View The Chart

Wednesday 24-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close

Wednesday 24 January 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Tuesday 23-January-2024, 07h47 | AECI Ltd (AFE) | Re-tested it's previous breakout level and looking to break above short term downward trend line resistance. Elevated volume and strong candle structure could support a move to around the R119 level.

Tuesday 23-January-2024, 07h36 | Lighthouse Properties Plc (LTE) | I discussed the breakout on STXPRO ETF on Monday 18-Dec-2023 and it's been a theme which has continued to see follow-through. Following a strong reversal, LTE has traded in a consolidation range, with above-average volume on Friday and yesterday. The descending triangle is triggered above 762c.

Tuesday 23-January-2024, 07h18 | Fortress A (FFA) UPDATE: Now trading +10% on high volume. The original setup was published on Monday 08 January.

Tuesday 23-January-2024, 06h30 | Vodacom Group (VOD) Trading in the late stages of a 2-year falling wedge technical formation (positive) however the share is also below a declining 200-day SMA (negative). Medium term: possible development of an inverse head & shoulder since September. Also showing relative strength vs the JSE Top 40 Index. CLICK HERE TO VIEW THE CHART.

Tuesday 23-January-2024, 06h30 | Glencore Plc (GLN) High bearish momentum/approaching oversold on the three short term time frames: 2-day, 3-day and 7-day RSI. The conditions point to the potential for an ultra short term rebound. Very similar to the oversold conditions seen on BHG last week.

Tuesday 23-January-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close

Tuesday 23 January 2024, 06h30 | Tactical Trading Guide: JSE Equities. Automated Tool and Strategies are used to identify potential trading opportunities as well as highlight potentially significant technical developments across various time frames. This data highlights readings from the Tactical Trading Guide (Price Action Tool) which covers over 90 shares and which is also available as a live tool via the telegram group. The tool provides automated price analysis of all JSE-listed equities across 3 time frames: short (short term), medium (medium term) and long (long term). Readings are subject to change, based on the development of the subsequent price action. Click here to access the data.

Tuesday 23 January 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close.

Lester Davids

Analyst: Unum Capital

Comments