Notable

- Lester Davids

- Feb 6, 2024

- 30 min read

Updated: Feb 26, 2024

To trade, or open a new account, contact the Unum Capital Trading Desk:

E-mail: tradingdesk@unum.co.za | Call: 011 384 2923

Research Philosophy: Summary

My overall goal is to convey my best interpretation of the most relevant market information in order for you, as a client to: (1) understand the potential opportunities and manage the potential risks and (2) make informed decisions around trading opportunities.

All trade insights and ideas are intended to prepare and inform the trader about potentially attractive reward-to-risk opportunities with the aim of helping the client generate cash flow as part of a broader portfolio.

My intention is to utilize my insights to assess the 'best probability' and consider the range of outcomes under the potential scenarios.

Lester Davids

Analyst: Unum Capital

➡️ Monday 26 February-2024, 06h30 | TALKING POINTS | One day’s candle formation does not represent a trend, however, it can provide important information about the price action dynamics for an instrument. Friday’s pre-market readings via the Tactical Trading Guide provided traders with valuable information in order to manage risk for the day ahead. To me, the standout was the failure of local-facing shares to hold their range/prior session highs versus the strength in “Rand Hedge” shares, supported by a weakening ZAR. For example, Shoprite SHP’s pre-market reading stated: “Aggressive buying but do not chase (buy). Look for overshoot on the upside or failure to hold the session/range highs to short sell back to the 8-EMA” . Intraday, the share traded above the previous session’s high however failed to hold these levels. By the end of the session, the share lower by 3.4%, wiping out 3 days of gains. Other share that failed to hold their range highs? Truworths, Capitec Bank, Nedbank (overbought reading early in last week, Tuesday). On the other hand, as mentioned, buy/long side opportunities have presented themselves in the form of laggard, or names that have recently retraced. AGL Anglo American is one that I discussed on Tuesday morning, where the ‘distance vs the 200-week SMA’ was a feature that suggested ‘technical value’.The share closed the week at it’s highest level since 02-February (although into a declining 50-day exponential moving average). There is lots to discuss, but the data/analysis below also does a lot of the talking. Take opportunities selectively. Respect the price action/data. Know your time horizon. Get in, get out, get paid. All the best for the week ahead.

➡️ Monday 26 February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/qUJilciO/

➡️ Monday 26 February-2024, 06h30 | JSE Relative Sector Regimes, as of Friday’s close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Monday 26 February-2024, 06h30 | SAP Sappi |Over the medium term, the following is noted: Positioning itself above it’s 200-day simple moving average + looking to clear a 23-month downward trend. Clearing these levels with conviction would bring 5600c and 5850c into play. [The share reached my buy/long target of 4579c from the 04-December suggested entry of 4119c].

Click here to view the chart => https://www.tradingview.com/x/wPwlYBKs/

➡️ Monday 26 February-2024, 06h30 | VOD Vodacom |The R90 target has been reached (see original slide here), which is a multi-year swing low. Note the following: (1) a positive divergence as per the 14-day RSI and (2) a positive crossover a per the MACD technical indicator.

Click here to view the chart => https://www.tradingview.com/x/LGThMv4Y/

➡️ Monday 26 February-2024, 06h30 | CFR Richemont | The share is now higher by 34% from the chart published on Friday 20 October. Analyzing the Tactical Trading Guide, the reading points to an extended technical position where the buy/long reward-to-risk is unappealing. As of Friday’s close, the reading and chart is as follows:

➡️ Monday 26 February-2024, 06h30 | TGA Thungela Resources |Distance Divergence: Despite the share trading at it’s lowest level in 2 years, the share is trading at a close distance vs it’s 200-day SMA than the percentage print at the previous swing low. Initial risk/warning highlighted at R289 (October 2022 - Click here to view the original chart)

Click here to view the chart => https://www.tradingview.com/x/jhpDzpt1/

➡️ Monday 26 February-2024, 06h30 | JSE Banks vs JSE Top 40 Index |Relative Unwind | On Thursday, my JSE Relative Sector Screen showed that the banks were overbought relative to the JSE Top 40 Index (see graphic below), for the short term and ultra short term time frames while the Tactical Trading Guide stated that traders should monitor for failure to hold the previous session/range highs.

Click here to view the chart => https://s3.tradingview.com/snapshots/g/glJsYrqF.png

➡️ Monday 26 February-2024, 06h30 | Satrix Resources (STXRES) vs Satrix Financials (STXFIN) | The ratio chart is trading around a key inflection point i.e. the previous breakout level seen in 2020. In addition, the ratio is printing a positive divergence as per the 14-day RSI, which could be a precursor to a bullish reversal.

Click here to view the chart => https://s3.tradingview.com/snapshots/c/cNUWk9yX.png

➡️ Friday 23 February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/iI2Fupm2/

➡️ Friday 23 February-2024, 06h30 | JSE Relative Sector Regimes, as of yesterday’s close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Friday 23 February-2024, 06h30 | AMS Anglo American Platinum | Yesterday’s pre-market reading as per the Tactical Trading Guide (short term, 1 to 10 days): “Reward to risk becoming attractive for a buy/long position”. End of day/intraday: Large ‘Inside bar’ candle formation following Wednesday’s large red candle near the tail end of an already extended move + small positive divergence (14-day Relative Strength Index).

Click here to view the chart => https://s3.tradingview.com/snapshots/m/MV5rSOfm.png

➡️ Friday 23 February-2024, 06h30 | TRU Truworths | Strong upside follow-through from the early-January setup (original chart here) which looked for a print into horizontal support and a bullish reversal. From a low of ~6800c, the share traded at a high of 8023c during yesterday’s session. Rating as of yesterday’s close. This would be an optimal level to reduce the buy/long + monitor for subsequent failure to hold yesterday’s highs.

Click here to view the chart => https://s3.tradingview.com/snapshots/j/jqwvDwxk.png

➡️ Friday 23 February-2024, 06h30 | SOL Sasol Ltd | Yesterday’s pre-market readings for the short term (1-10 days), medium term (2 to 4 weeks) and long term (5 to 8 weeks) all stated the same: “The reward to risk is becoming attractive for a buy/long position”. The same across all three time frames suggests that the share was deeply oversold and possibly due a rebound. The share closed higher by 4.13% on the day. It’s a start. Now to see a base build and the buying pressure outweighing the selling pressure. Do note that on Monday 26-Feb earnings are set to be released. This creates 'event risk'.

Click here to view the chart => https://s3.tradingview.com/snapshots/v/VxbPoxZ9.png

➡️ Friday 23 February-2024, 06h30 | NPN Naspers | As discussed Wednesday’s pre-market reading called for a potential rebound (Tactical Reading: “Expect Small Rebound”) in the share following a short term pullback. Wednesday’s low of the day was in line with Tuesday’s daily range while yesterday we saw further upside follow-through with a high of R3342.23. If you are an ultra short term trader, then the minor rebound was an opportunity to book profits then waiting for a retracement to re-enter on the buy/long side.

➡️ Friday 23 February-2024, 06h30 | MNP Mondi plc | Further Update: Strong reversal from the suggested tactical re-entry at 31486c. High of 34244c during yesterday’s session. If you are a short term trader, you could look to trim/reduce.

Click here to view the chart => https://s3.tradingview.com/snapshots/u/uDzGpArw.png

➡️ Friday 23 February-2024, 06h30 | AVI Ltd | Massive upside follow-though from the bull flag setup at R68 (published Monday 24 July). Now trading into resistance + negative divergence as per the 14-day RSI. Also noted is the share trading around 4x it’s average distance vs it’s 200-day SMA over the last decade. See the two charts below:

➡️ Thursday 22 February-2024, 12h18 | NED Nedbank Group | Monday’s end-of-day reading as per the Tactical Trading Guide (short term 1 - 10 days) stated the following: “Very strong move, buyers in control but do not chase. The share may fail at it’s attempt to hold it’s highs, which will present an opportunity to short/sell back to the 8-day EMA”. Over the 3 days, the share has retraced from a high of R230 to today’s low of R224.30 which was in line with the 8-EMA (short/sell target as per the TTG).

Click here to view the chart => https://s3.tradingview.com/snapshots/x/XY18cP2W.png

➡️ Thursday 22 February-2024, 11h43 | Copper/Gold Ratio | The relative/ratio chart is used as an input to determine the health of the global economy. My technical analysis of the ratio chart highlights the following: (1) Several months of support at a defined horizontal level (positive factor) (2) Price below it’s declining 200-day simple moving average (negative factor) (3) Price attempting to clear the 1-year downward trend line (positive factor).

Click here to view the chart => https://s3.tradingview.com/snapshots/2/2KGOLuXV.png

➡️ Thursday 22 February 2024, 06h30 | JSE Top 40 Index | Analyst Comment: The 66072 level has remained support, with buying off the lows during yesterday's session | Short Term Rating: Neutral | Price vs 8/21-EMA: Below | Price vs 50-EMA: Below | Price vs 200-day SMA: Below

Click here to view the chart=> https://s3.tradingview.com/snapshots/y/YoUY8tb0.png

➡️ Thursday 22 February 2024, 06h30 | Selected Shares From The Tactical Trading Guide: Click on the share to view the reading & chart | NPN Naspers | SBK Standard Bank | BHG BHP Group |

➡️ Thursday 22 February 2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/Lx5Iu7Rv/

➡️ Thursday 22 February 2024, 06h30 | CPI Capitec Bank | If the share fails to hold it's range highs, that could represent an opportunity to sell/short.

Click here to view the chart => https://s3.tradingview.com/snapshots/v/vUvMGO8d.png

➡️ Thursday 22 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Thursday 22 February 2024, 06h30 | JSE Relative Sector Ratings, as of yesterday's close.

➡️ Wednesday 21 February-2024, 15h15 | Invesco Trust Nasdaq 100 ETF (QQQ) | Key Points (1) Breach of horizontal support (2) Potential to close unfilled gap at $422.38 (3) Weak Regime (4) Breach of incline support.

Click here to view the chart => https://s3.tradingview.com/snapshots/w/wYdaqsmE.png

➡️ Wednesday 21 February-2024, 12h01 | S&P 500 Index Future (ES1) | While we have seen breadth deteriorate over several weeks, the index has managed to maintain it's elevated levels, supported by narrow stock leadership among selected large cap constituents. This is dynamic changing as the index is showing signs of weakness and starting to unwind from these highs, while the momentum indicators (14-day RSI as one of them) has started to print new multi-week lows.

Click here to view the chart => https://s3.tradingview.com/snapshots/g/gaa6UQYF.png

➡️ Wednesday 21 February-2024, 09h45 | BID Corp | The pullback in the BID share price isn't unexpected and was highlighted by the Tactical Trading Guide at the end of day on Thursday 01 February which stated the following: "Aggressive buying but overbought on the lower time frame. Expect a consolidation or minor retracement". From around R470, we have seen the share unwind to near R422 with further selling today on the back of it's results (these we strong results with the highlights as follows: Revenue R113,8 billion, up 24,0% • Trading Profit R5,9 billion, up 20,8% • HEPS 1152,4 cents, up 18,6% • EPS 1143,8 cents, up 17,6% • Cash generated by operations (before working capital) up 11,3% to R6,8 billion • Interim dividend declared up 19,3% to 525,0 cents per share"). The share has retraced into it's 200-day SMA with buying off the lows (at the time of writing). Also note at today's lows, the share is near it's previous breakout level.

Click here to view the chart => https://s3.tradingview.com/snapshots/8/846JVHTJ.png

Note: I also discussed BID on Monday 05 February at R470 (see extract below), highlighting a less-than-favourable buy/long reward-to-risk.

➡️ Wednesday 21 February-2024, 07h55 | NPN Naspers Ltd | With Tencent +3% in Hong Kong this morning, it is likely that NPN rebounds in line with this move. As per yesterday's end of day tactical trading guide, the short term reading (1-10 days) is as follows "...expect a small rebound". See below:

Also note, NPN having retraced into it's rising 50/100-EMA range, while also close to filling the unfilled gap. Click here to view the chart => https://s3.tradingview.com/snapshots/f/FZzPvzPn.png

➡️ Wednesday 21 February-2024, 06h30 | Flash Comments - Pre-Market Tuesday, 21 February 2024 |

CLS Clicks: strong candle | WHL Woolworths: strong candle | SPP Spar: breaking below multi-month support | CFR Richemont: Negtaive divergence starting to reflect in the price.

➡️ Wednesday 21 February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/jtgFV3mo/

➡️ Wednesday 21 February-2024, 06h30 | JSE Top 40 Index | The resistance levels around the declining 8 and 21-EMA range held on Friday and Monday, with the index struggling to surpass this range. The pre-determined resistance area of 67409 also held, coinciding with the exponential moving averages. Also note the price below it's 75-EMA which is showing a downside bias.

Click here to view the chart => https://s3.tradingview.com/snapshots/2/2eBXXRBe.png

➡️ Wednesday 21 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Wednesday 21 February-2024, 06h30 | NED Nedbank Group | Coming in yesterday, NED was the only share is a short term overbought range, as per the technical summary. We saw the share negative on the day but holding near the range highs. If it becomes too extended (for example a pint near R234 to R238), then a tactical back to the breakout level would make sense. Otherwise, the breakout level back at R220 is a logical range to consider a buy/long re-entry.

Click here to view the chart => https://s3.tradingview.com/snapshots/i/I7c6R1wo.png

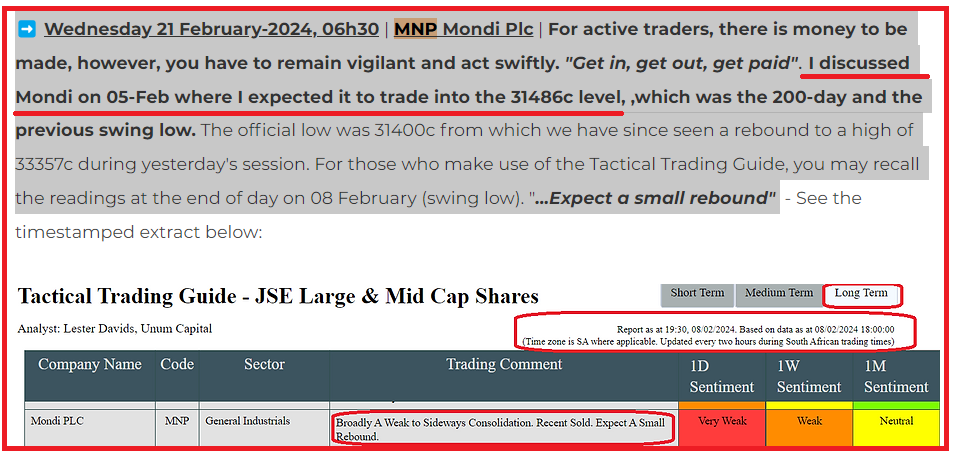

➡️ Wednesday 21 February-2024, 06h30 | MNP Mondi Plc | For active traders, there is money to be made, however, you have to remain vigilant and act swiftly. "Get in, get out, get paid". I discussed Mondi on 05-Feb where I expected it to trade into the 31486c level, ,which was the 200-day and the previous swing low. The official low was 31400c from which we have since seen a rebound to a high of 33357c during yesterday's session. For those who make use of the Tactical Trading Guide, you may recall the readings at the end of day on 08 February (swing low). "...Expect a small rebound" - See the timestamped extract below:

Click here to view the updated chart => https://s3.tradingview.com/snapshots/y/yCPTBuYD.png

➡️ Tuesday 20 February-2024, 08h46 | FX: USD/ZAR [Linear Regression Analysis 21-Days] ➡️ Range: (0) Mean [Technical Fair Value] ➡️Range of Price Action Outcomes In This Zone: (1) consolidates in this range or (2) finds buyers on an intraday basis, then clears the range highs (3) finds sellers on an intraday basis, then breaches the range lows. ➡️Trader’s Potential Action In This Range: Look for: (1) Consolidation followed by: (1) failure to hold highs, with strong offers or (2) holding highs, with strong bids.

Click here to view the chart => https://www.tradingview.com/x/w0WAjl62/

➡️ Tuesday 20 February-2024, 08h41 | JSE Top 40 Index [Linear Regression Analysis 21-Days] ➡️ Range: (0) Mean [Technical Fair Value] ➡️Range of Price Action Outcomes In This Zone: (1) consolidates in this range or (2) finds buyers on an intraday basis, then clears the range highs (3) finds sellers on an intraday basis, then breaches the range lows. ➡️Trader’s Potential Action In This Range: Look for: (1) Consolidation followed by: (1) failure to hold highs, with strong offers or (2) holding highs, with strong bids.

Click here to view the chart => https://www.tradingview.com/x/SRTb5jcB/

➡️ Tuesday 20 February-2024, 06h30 | Technical Screen: Price vs 75-Day EMA | Ascertaining an instrument's price vs it's 75-day exponential moving average is an effective way of measuring short to medium term reward-to-risk. The accompanying tables highlight the top 10 most extended vs the 75-EMA on both the up and the downside. Red shaded area = nearing expensive (sell/reduce). Blue shaded area = nearing cheap (buy/add).

➡️ Tuesday 20 February-2024, 06h30 | CFR Richemont | The is +30% from my chart/comment citing the potential for a piercing candle which is a bullish reversal setup [See the original chart here.] The recovery has been driven by a change in sentiment with regard to the luxury sector (globally). The short term trend is higher, therefore a short/sell from at or current levels could be considered a risky trade, however here are some factors that may suggested the share is nearing short term overbought conditions: (1) trading at the upper boundary of it's 200-day linear regression channel (2) trading 12% above it's 50/100-EMA range (3) MACD histogram losing momentum (4) minor divergence on the 14-day RSI. Note: there is a gap at R3157 that has the potential to be be filled (on the upside). Upward momentum is strong but if the share fails to hold the range then that could present an opportunity for ultra short term/short term traders

Click here to view the chart => https://s3.tradingview.com/snapshots/1/1L9XtGNM.png

➡️ Tuesday 20 February 2024, 06h30 | AGL Anglo American Plc | DISTANCE: Relative to the Top 40 Index, AGL is extended vs it's 200-week by the most (%) since late-2016. On an absolute basis, the AGL is extended vs it's 200-week by the most (%) since August 2016. These extensions may be indicative of a 'technical value zone' and a potentially appealing reward-to-risk on a buy/long side.

Click here to view the chart => https://www.tradingview.com/x/HiDscqgH/

[One year ago (January & February 2023) I discussed (via this research platform) the risk for potential downside in the share. Since the first comment in January at R752, the share has lost 47% to a low of R395. Original comments/charts can be viewed here and here.]

➡️ Tuesday 20 February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/jUg1whIn/

➡️ Tuesday 20 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Tuesday 20 February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Monday 19 February 2024, 14h41 | S&P 500 Index (E-Mini Future) | Further to my previous comments around the extension of the index (e.g. deteriorating breadth), the chart highlights the distance divergence versus the 50/100-EMA range (i.e. 75-EMA). While the index has developed high highs, the distance vs the EMA is printing lower highs. See previous annotations on the chart (vertical lines).

Click here to view the chart => https://www.tradingview.com/x/uFSdciDS/

➡️ Monday 19 February 2024, 06h30 | TALKING POINTS | ➡️ US Equities: negative closes on the S&P500, Nasdaq, Dow Jones and Russell 2000 indices ➡️ US 10-Year yield breaking out of a 3-week range, remains above it's rising 8, 21-EMA ➡️ Brent Crude Oil: at the upper end of a multi-month range ➡️ JSE: Strong rebound to close near the highs of the week, but below it's declining 21-day exponential moving average ➡️ JSE Sectors: Banks showing relative strength; Diversified Miners - a late-week recovery near multi-month lows. JSE Telecoms at multi-year lows ➡️ SA Budget (Wed, 21-Feb) ➡️ US earnings season continues, big focus on Nvidia (Wed, 21-Feb) + among others, Home Depot, Walmart, Etsy & Berkshire Hathaway ➡️ Federal Reserve Open Market Committee (FOMC) Minutes on Wed, 21-Feb.

➡️ Monday 19 February-2024, 06h30 | My Global Risk Index is comprised of the following components. (1) Copper (2) High Beta vs Low Beta (3) Growth vs Value (4) EM Currencies (5) AUD/USD (6) Consumer Staples vs Consumer Discretionary (7) Semiconductors vs S&P 500 (8) Russell 2000 ETF (9) U.S. Dollar Index (Inverse). Rising Trend Line = Risk On; Falling Trend Line = Risk Off. Click here to view the chart => https://www.tradingview.com/x/GItllWDI/

➡️ Monday 19 February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of Friday's close.

To view the technical summary, click here => https://www.tradingview.com/x/tucgZdZG/

➡️ Monday 19 February 2024, 06h30 | JSE Relative Sector Regimes, as of Friday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Monday 19 February-2024, 06h30 | Satrix Resources (STXRES) vs Satrix Financials (STXFIN) | The ratio chart is trading around a key inflection point i.e. the previous breakout level seen in 2020. In addition, the ratio is printing a positive divergence as per the 14-day RSI, which could be a precursor to a bullish reversal.

Click here to view the chart => https://www.tradingview.com/x/qwYlmn8r/

➡️ Monday 19 February 2024, 06h30 | JSE Staples/JSE Discretionary x USDZAR x Rand-Oil Price | The ratio chart of Staples vs Discretionary shares gives us important information with regard to the type of environment that we are in, or point to an environment that we may find ourselves in. Does the ratio moving lower (upper panel) point to a strong Rand (middle panel) as well as a lower Rand-Oil price (lower panel)? Click here to view the chart => https://www.tradingview.com/x/oxvsEv6f/

➡️ Monday 19 February 2024, 06h30 | JSE Banks vs JSE Insurers | Within the financials space, how might traders want to be positioned? The ratio chart considers the performance of banks relative to insurers. Line Up = Banks Outperforming Insurers / Line Down = Banks Underperforming Insurers

Click here to view the chart => https://www.tradingview.com/x/Q3prjRPA/

➡️ Monday 19 February 2024, 06h30 | ANG Anglogold Ashanti | Consolidating below it's 200-day simple moving average (which is starting to turn lower) / Stuck below it's 200-week simple moving average. Click here to view the chart => https://www.tradingview.com/x/2JzKT4xE/

➡️ Monday 19 February-2024, 06h30 | NED Nedbank | Breakout + Approaching The Target | ABSOLUTE & RELATIVE | On 11 January I discussed the multi-month base and the R220 level as a pivot for further potential upside. On an absolute basis, NED traded at a 6-month high during Friday's session while on a relative basis (vs the JSE Top 40 Index), the share is trading at a 14-month high (best level since December 2022). Both the absolute and relative price action/candle structures are constructive.

Click here to view the chart => https://www.tradingview.com/x/X1zsyeYZ/

➡️ Monday 19 February-2024, 06h30 | The Pros and Cons of Standard Bank (SBK) | PROs: (1) Accelerating to upside within a consolidation zone, at multi-month highs (2) Relative strength versus the broader market (3) Friday saw above-average volume (4) Strong candle structure (5) Could be a beneficiary of flows back into Emerging Markets.

Click here to view the chart => https://s3.tradingview.com/snapshots/3/3Ewd1nQz.png

Cons: (1)Approaching multi-month swing highs (2) Extended by 37% versus it's 200-week SMA. Although this extension can persist, it is one of the highest readings in several years.

Click here to view the chart => https://www.tradingview.com/x/L47Tkq7z/

➡️ Monday 19 February-2024, 06h30 | SSW Sibanye Stillwater | The risk is that the share trades toward the lower boundary of the multi-year channel. The technical 'margin of safety' is that the share is trading 53% below it's 200-week simple moving average. By historical measures, this coincides with an appealing reward-to-risk on the buy/long side. Also note the inside bar being printed last week (along with Impala Platinum).

Click here to view the chart => https://www.tradingview.com/x/3LPRjPtw/

➡️ Monday 19 February-2024, 06h30 | Impala Platinum | Sticking with the platinum sector, Impala Platinum also finds itself near multi-year lows. As you may have previously seen, I have used 'DISTANCE vs Moving Average' as a tool to identify risks and potential opportunities. Last year, on Monday 27 March 2023, I published a chart which showed the share breaking below it's 200-week SMA in a similar manner to that of the previous breakdown which led to a 'continuation sell' signal. From R166.87 at the time, the share has since tested a low of 6158c. At current levels, the share trades at 61% below it's 200-week simple moving average. By historical measures, this is NEAR cycle troughs (may NOT BE the exact bottom) and has coincided with 'VALUE LEVELS' in the share.

IMP: The original chart (Monday, 27 March 2023) is shown below.

➡️ Monday 19 February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Friday 16 February 2024, 12h57 | SPDR Energy Sector (XLE ETF) vs Russell 3000 (IWV ETF) | What does this chart highlight? The performance of the energy sector relative to the average US stock, as represented by the Russell 3000 (IWV ETF) | Why is it significant? The following factors shows the potential for the start of a bottoming formation: (1) Strong candle structure (2) bullish divergence as per the 14-day RSI (3) bullish divergence as per the MACD. The aforementioned factors suggests that traders should continue to seek opportunities in the energy sector.

CLICK HERE TO VIEW THE CHART => https://s3.tradingview.com/snapshots/g/gXyeqnNN.png

➡️ Friday 16-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/B79ZZb7P/

➡️ Friday 16 February 2024, 06h30 | JSE Top 40 Index (J200) | The pre-market '1st support zone' was recognized by market participants as an intraday value zone'. This follows yesterday's rebound around the same level. The index found intraday resistance around the pre-market level of 66821, which is just below the declining 8-EMA. Key support/resistance levels are shown on the chart.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/qv3w11uc/

➡️ Friday 16 February 2024, 06h30 | IMP Impala Platinum | On Tuesday morning, I discussed Monday's inside bar in the form of a 'doji' formation, which was subsequent to Friday's large red candle following an extended downward trend. On Tuesday and Wednesday we saw a base develop, while yesterday the oversold conditions were unwound with a strong move to the upside (+5.46%).

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/uyG14YCA/

➡️ Friday 16 February 2024, 06h30 | MTN Group | Downward Momentum Slowing? | The share in a high bearish momentum phase and risks a further correction down to the previous low of ~8700c. It should however be noted that the MACD is showing early signs of a potential bullish crossover (+ slowing histogram) while the 14-day RSI is developing a positive divergence.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/ppbp1T2v/

➡️ Friday 16 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Friday 16-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Thursday 15-February-2024, 06h30 |Gold Miners (Equally-Weighted) are threatening to break down relative to the JSE Top 40 Index | This means that the sector could continue to underperform the overall market.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/QgUxg99f/

➡️ Thursday 15-February-2024, 06h30 | SLM Sanlam & Sanlam vs Top 40 | On an absolute basis, Sanlam is trading just below multi-year highs, however, having traded in a tight range for several weeks. This is a healthy technical development. On a relative basis, the share is trading near 52-week highs versus the broader markets (Top 40 as a proxy). Also note yesterday's elevated volume. This is a potential swing buy/long (continuation) trade setup.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/fkhvm0Kx/

➡️ Thursday 15-February-2024, 06h30 | JSE Coal Miners (Equally-Weighted) Relative To The JSE Top 40 Index | This is not a trading signal but rather an observation which highlights a short term technical development. This is a ratio chart which highlighted JSE Coal Miners (EXX, TGA) Equally-Weighted Relative To The JSE Top 40 Index. The lower panel shows a small positive divergence as per the 14-day RSI while the upper panel shows a bullish crossover on the MACD.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/TckR1pRi/

➡️ Thursday 15-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/HCpXaXCI/

➡️ Thursday 15-February-2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Thursday 15-February-2024, 06h30 | JSE Top 40 Index (J200) | The pre-market '1st support zone' was recognized by market participants as an intraday value zone'. This follows several days of selling pressure which saw the index shift below it's now downward-trending 8, 21-EMA range.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/Ajt6rJkb/

➡️ Thursday 15-February-2024, 06h30 | JSE Top 40 Index: Linear Regression Analysis 21-Days

➡️ Range: (-1) Lower [High Bearish Momentum] ➡️Range of Price Action Outcomes In This Zone: (1) opens higher, then finds sellers on an intraday basis, possibly at the 8-EMA or (2) opens lower, trades into the oversold range, opening up a potential buy/long trade ➡️Trader’s Potential Action In This Range: (1) Consider, or start a small buy/long position (for e.g. 1/3) or monitor for candle structure which suggests that downside momentum is slowing (doji, long lower tail, pin bar etc) or (2) Consider starting to reduce existing short/sell position.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/HAxFKu4a/

➡️ Thursday 15-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Wednesday 14-February-2024, 19h01 | PLATINUM | In preparation for tomorrow notes, these are the short term technical developments I'm seeing on the Platinum chart.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/SfR8zwsw/

➡️ Wednesday 14-February-2024, 06h30 | TALKING POINTS | Last week Monday, I highlighted several key factors related to market breadth for the S&P 500 Index, which provided key information with regard to the underlying deterioration in light of the index trading at record highs. In case you may have missed it, my comments were as follows: "Record Highs, However, Here Are Some Statistics To Consider:➡️ Only 64% of shares are trading above their 50-day moving average versus 91% on 02-January. This is a bearish divergence. ➡️ Only 70% of shares are trading above their 200-day moving average versus 78% on 02-January. This is a bearish divergence.➡️ The Equity Risk Premium is at it's lowest level since 2021. ➡️ The percentage of shares with RISING moving averages is starting to roll over." Over the course of the week, the number of shares making new lows outpaced those making new highs, which further reinforced the view that the reward-to-risk at the index level was unappealing. Yesterday's high-than-expected inflation print exposed the underlying 'risk-off' positioning which had been developing over several weeks. The research which I publish falls into two categories: (1) OPPORTUNITIES, which is direct trade ideas and (2) INIGHTS, which is key data/charts that is conveyed to help clients understand various key aspects of the market. The charts below (insights) were highlighted here last week and were vital to understanding the broader reward-to-risk dynamics. Overnight, US markets closed sharply lower, confirming the underlying data below.

➡️ Wednesday 14-February-2024, 06h30 | JSE Top 40 Index (J200) | For the better part of the session, indecision was the order of the day as the trading range remained narrow with the development of a 'doji' candle structure in the run-up to the US CPI print. Much of the trading took place just below the declining 8 & 21-Day Exponential Moving Average (EMA) as well as below the previous short term breakdown level i.e. 67409. As discussed on Monday, the declining 8-EMA would prove a challenge to bulls with the level being the first upside resistance zone on any rebound. Yesterday we saw this development come to fruition with the high of the day being into the intersection of the declining 8/21-EMA followed by a sharp sell-off into the afternoon and a close near the lows of the day. The candle structure is reflective of sellers continuing to control the short term trend. The support/resistance levels are highlighted on the chart.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/gnlHrpUY/

➡️ Wednesday 14-February-2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Wednesday 14-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/JdX3SH5s/

➡️ Wednesday 14-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Tuesday 13-February-2024, 14h18 | CNYUSD vs Satrix Resources (STXRES). What does this chart highlight? The divergence between the Satrix Resources ETF/Portfolio and the Chinese Yuan/US Dollar currency pairs. Why is it significant? While the STXRES ETF has printed lower lows, the CNYUSD currency pair has printed higher lows. The gradual bullish reversal in the CNYUSD pair could be indicative of a potential bullish reversal in STXRES.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/FbSnwAPT/

➡️ Tuesday 13-February-2024, 13h52 | S&P 500 Index (SPY ETF) vs iShares 20-Year Treasury Bonds (TLT ETF) | What does this chart highlight? The divergence between equity gains on the S&P 500 and Bonds. Why is it significant? The previously close correlation could revert to the mean, which could see equities moving lower WITH bonds.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/DATV3dBw/

➡️ Tuesday 13-February-2024, 13h45 | Brent Crude Oil vs US 10-Year Bond Yields | With energy/oil being a large part of the inflation basket, I compare the two instruments, with the upper panel showing Brent Crude Oil ticking higher while US 10-Year Bond Yield following a similar trajectory. Further gains in oil could lead to higher bond yields, which in turn might be a negative for equities.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/rYCrkxxA/

➡️ Tuesday 13-February-2024, 06h30 | US Equity Factor Performance (1 Day)

➡️ Tuesday 13-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close.

To view the technical summary, click here => https://www.tradingview.com/x/aTzL8bZQ/

➡️ Tuesday 13-February-2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Tuesday 13-February-2024, 06h30 | STXRES Satrix Resources/JSE Diversified Miners | On an absolute basis, there are two points to note: (1) the ETF is in a strong downward trend however, may be nearing an inflection point with the price nearing the prior demand supply zone. In addition, yesterday the ETF saw it's highest volume in just over a month. CLICK HERE TO VIEW THE CHART (2) On a RELATIVE BASIS, the JSE Diversified Miners printed an 'inside bar' vs the JSE Top 40 Index.

➡️ Tuesday 13-February-2024, 06h30 | Impala Platinum (IMP) | Significant de-rating from R93 to R62. Monday's pre-market reading highlighted the share being in an oversold range with the medium (2 to 4 weeks) and long term (5 to 8 weeks) readings stating that the 'reward-to-risk is becoming attractive for a small buy/long position'. Also note the following: Friday's close was a large bearish candle which is within a downward trend that is mature. This was followed by a 'doji candle' (indecision) that developed during the Monday's session.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/12z6Spi1/

➡️ Tuesday 13-February-2024, 06h30 | Shoprite Holdings (SHP) | Last week Wednesday's (highlighted) bear flag formation is starting to unfold with the share having tested it's lowest level since January. Also note the above-average volume on the move lower (2nd highest volume since September).

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/hSb2Igge/

➡️ Tuesday 13-February-2024, 06h30 | Update: Cybersecurity ETFs | Strong Follow-Through For iShares MSCI Cybersecurity & Tech (IHAK) | This has been one of the strongest sectors of the market, with the themes being structural in nature as opposed to cyclical. On Friday, the ETF closed at an all-time high of $49.50 vs the $36.60 at the time of publication in May of last year. This marks a +35% on the instrument. Over the same period, the return for the top 3 holdings are as follows: SentinelOne (S) +105%, CrowdStrike (CRWD) +115% and CyberArk Software (CYBR) +66%.

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/yD0EFzBB/

To trade international shares, you will need to open an offshore account. To get started, contract the Unum Capital Trading Desk today.

➡️ Tuesday 13-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Monday 12-February-2024, 16h03 | QCOM Qualcomm Inc | Trade Alert - published to CMS and Telegram Group

CLICK HERE TO VIEW THE CHART => https://www.tradingview.com/x/75oBx7qk/

➡️ Monday 12-February-2024, 10h56 | JSE Top 40 Index - Short Term Technical Analysis | The index trades at a 2 1/2 week low, with the price just below (in close proximity to) it's 8 & 21-day exponential moving averages. Both of these EMAs have started to turn down which may be reflective of a potential acceleration of the short term downward which has already commenced. The candle structure (as of the time of writing i.e. 10:50am) shows a 'doji' which suggests indecision between buyers and seller or measure of a equal control for the session. An ultra short term rebound in price is likely to be rejected at the intersection of the declining 8/21-EMA. Long term, the index remains below it's 200-day simple moving average, which has a flat to downward trending bias.

CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/6oS0cSS7/

JSE Top 40 Index Multiple Time Frame Regimes => https://www.tradingview.com/x/WyNHINI1/

➡️ Monday 12-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of Friday's close.

To view the technical summary, click here => https://www.tradingview.com/x/E5LLs2Zu/

➡️ Monday 12-February-2024, 06h30 | JSE Relative Sector Ratings, as of Friday's close.

CLICK HERE TO VIEW DATA => https://www.tradingview.com/x/Rvx7n7RW/

➡️ Monday 12-February-2024, 06h30 | JSE Relative Sector Regimes, as of Friday's close. To view the charts, click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Monday 12-February-2024, 06h30 | JSE Industrials. The global industrial sector has been one of the strongest, with the group making new all-time highs in the United States (see the XLI ETF). Earnings from various sub-sectors has validated the price action, with multiple companies exceeding analyst expectations while also raising their outlooks for the upcoming year. The sentiment may be filtering through to the local market, with JSE Industrials (using the STXIND ETF as a proxy), also looking to emerge from a multi-month consolidation zone (CLICK HERE TO VIEW THE WEEKLY CHART). Comparing the STXIND ETF to the Top 40 Index, the group is re-emerging with the ratio chart reflecting the group breaking out of a 4-year base.

CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/0DhiDeXp/

➡️ Monday 12-February-2024, 06h30 | CFR Richemont | The luxury sector continues to show signs of recovery with CAC-listed Hermes reporting strong sales growth (Q4 2023 +17% vs analyst expectations of +14%). This bodes well for the potential of CFR to continue it's move higher. On a relative basis, the share has continued to trend higher, having reversed off the lower boundary of the gradual upward trending channel. CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/2t7bhtMu/

➡️ Monday 12-February-2024, 06h30 | NPN Naspers Ltd vs JSE Top 40 Index | This remains a high risk share however it should be noted that Naspers is breaking out to a 2 & 1/2 year relative high versus the broader market. CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/2KUb30Dk/

➡️ Monday 12-February-2024, 06h30 | SOL Sasol Ltd | Breaking the lower boundary of it's downward trending channel (CLICK HERE TO VIEW CHART). The bigger picture structure continues to play out (lower). The share is down by 75% in US Dollar terms.

CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/mX8n4Uuv/

➡️ Monday 12-February-2024, 06h30 | MTN Group | The OVERBOUGHT conditions are the previous demand-supply zone as well as the reading via the tactical trading guide and guarded clients against participating on the buy/long side. Subsequently we have seen the share unwind sharply with the high bearish momentum suggesting that the share could revisit it's multi-month lows at 8700c printed on 02 November 2023.

CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/VvhxpHsu/

➡️ Monday 12-February-2024, 06h30 | GRT Growthpoint Properties Relative To The JSE Top 40 Index | The monthly RSI is clearing a 12-year downward trend combined with positive divergence. Also note the upper panel reflecting a positive divergence.

CLICK HERE TO VIEW CHART => https://www.tradingview.com/x/8BNvGhaw/

➡️ Monday 12-February-2024, 06h30 | Long Term Signals: Relative To The JSE Top 40 Index |

CLICK HERE TO VIEW CHARTS => MRP Mr Price | BVT Bidvest Group | SPP Spar Group

➡️ Friday 09-February-2024, 06h42 | FX: GBP/JPY | Following a multi-month consolidation, a new trading range is looking to be established. Bias: Buy/Long.

Click here to view the chart => https://www.tradingview.com/x/ytLTDnSS/

➡️ Friday 09-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close. To view the technical summary, click here => https://www.tradingview.com/x/3bDPJ8RQ/

➡️ Friday 09-February-2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Friday 09-February-2024 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Thursday 08-February-2024, 15h24 | GFI Gold Fields | On 02-February, GFI closed it's gap and subsequently printed a massive bearish reversal candle. The day before that, the share closed closed strongly (at the highs of the day) however, was in an OVERBOUGHT range as per the end-of-day technical summary. The Tactical Trading Guide also warned that the share was at risk of failing to hold it's highs and retracing toward it's 8-day EMA. We have seen this unfold over the last 5 sessions, with the provisional level of interest i.e. the 21/50-EMA now being a focus zone. Thus far today, this is where the share is finding support.

Click here to view the chart => https://www.tradingview.com/x/fV57QhKA/

➡️ Thursday 08-February-2024, 14h04 | NPN Naspers | Key Point: Unwinding from overbought, but remains in a bullish regime. This morning's pre-market rating for the share (via the technical summary) was OVERBOUGHT, with the tactical trading guide stating the following: "Very strong move with buyers in control however, do not chase, as the share may fail at it's attempt to hold it's highs, with would be an opportunity to short/sell back to the 8-EMA". The pre-market reading is shown below.

Click here to view to the current chart => https://www.tradingview.com/x/1lj7vmyU/

➡️ Thursday 08-February-2024, 11h41 | SPY S&P 500 ETF | The ETF remains in a high momentum regime, with the record highs in sight and the key round number i.e. 5000 in focus. To elaborate, the price remains above it's rising 8-EMA, which is above it's 21-EMA. Yesterday's high of $498.53 will be closely watch to monitor if it holds, while the downside gap at $494.41 will be focus for a potential close. As of pre-market, the 8-EMA is at $492.24 while the 21-EMA is at $485.51. Consider the following: a if the share rises above it's previous day's high and fails, this could signal an exhaustion of the current bullish momentum and a precursor to a potential reversal. Candle structures that could signal a bearish reversal: 'long upper tail', 'dark cloud cover'.

Click here to view the chart => https://www.tradingview.com/x/ORTn4Pni/

➡️ Thursday 08-February-2024, 10h42 | BTI British American Tobacco | Update: Now Higher by 10% Ungeared. The share is back at a 2-month high, with the market welcoming it's results for the year ended 31 December 2023. As discussed in the research on 07 December, the sharp drop on 06 December saw the price trade into the lower boundary of the parallel channel (see chart here) that had been in place for one year (since December 2022). In addition, the reading via the end-of-day Tactical Trading Guide stated the following: "Aggressive selling recently, however the buy/long reward-to-risk may be attractive" (click here for the original reading).

➡️ Thursday 08-February-2024, 09h54 | XPO | New all-time highs on the back of strong earnings + a positive outlook. Now trading higher by 34% over the two weeks since publication. To trade global shares, you will need an offshore account.

➡️ Thursday 08-February-2024, 08h42 | Bytes Technology Group, Provisional Buy/Long Setup - on confirming price action. Click here to view the chart => https://www.tradingview.com/x/eBqA1LUN/

➡️ Thursday 08-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close. To view the technical summary, click here => https://www.tradingview.com/x/p2g0PZ8a/

➡️ Thursday 08 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Thursday 08-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Wednesday 07-February-2024, 14h12 | GLN Glencore Plc | Bigger picture (via the monthly chart), GLN has continued to see weakness, unwinding following the bearish MONTHLY MACD crossover. The re-test of the R70 multi-year breakout level opening up as a possibility.

Click here to view the chart=> https://www.tradingview.com/x/wj8IwR3h/

➡️ Wednesday 07-February-2024, 12h36 | AVI Ltd | The bull flag technical formation I discussed in July at 6708c has seen significant upside follow-through with the share trading at it's highest level since November 2021 (print of 8791c on Tuesday). The 14-day RSI is close to 75, which reflects strong price momentum but also suggests that the share is nearing an overbought range. Analyzing the price, you'll note the share is nearing the swing highs of December 2019 and September to November 2021. I would view these zones as levels to reduce into strength.

Click here to view the chart=> https://www.tradingview.com/x/l3IuvNXQ/

➡️ Wednesday 07-February-2024, 08h27 | PLTR Palantir Technologies | Yesterday in New York, PLTR closed higher by 30% on the day, with volume of 421 million shares traded - it's highest volume day ever. Well done to all who took the opportunity to trade. Clients were alerted to the opportunity on 09 January. Click here to view => https://www.tradingview.com/x/9gqos6Df/

➡️ Wednesday 07-February-2024, 08h11 | CPI Capitec Bank: Yesterday morning (pre-market) I highlighted the share, it's structure, but more importantly the previous day's above-average volume. If you exclude 18 December 2023 (futures closeout), then yesterday's volume was the highest since 08 September. For further context, the volume is 40% above it's 90-day average. The institutional footprints are worth noting.

Click here to view the data => https://www.tradingview.com/x/bsS7H1co/

➡️ Wednesday 07-February-2024, 06h30 | Technical Summary: Mid & Large Caps, as of yesterday's close. To view the technical summary, click here => https://www.tradingview.com/x/LUNLQegn/

➡️ Wednesday 07-February-2024, 06h30 | Tactical Trading Guide (Share Commentary): Largest 40 Shares By Market Cap. Click here to access the data set => https://www.unum.capital/post/tactical-trading-guide

➡️ Wednesday 07 February 2024, 06h30 | JSE Relative Sector Regimes, as of yesterday's close. To view the data set click on the following links: Chart #1 | Chart #2 | Chart #3

➡️ Wednesday 07-February-2024, 06h30 | SHP Shoprite Holdings | The share price is developing lower highs within a rising short term channel that resembles a bear flag technical formation. Over a six-day period support has consistently been in the ~26660c range reflecting some buying interest around this area. Losing support at this zone would coincide with a break of the lower boundary of the bearish channel formation.

Click here to view the chart => https://www.tradingview.com/x/myA5BH2W/

➡️ Wednesday 07-February-2024, 06h30 | TGA Thungela Resources | This is a broken name, with the price below declining 50-day and 200-day moving averages. The key level is 12300c, meaning that the share needs to reclaim this zone to support a potential bullish reversal. Since late January, the share has been in a short term consolidation zone (11550c to 12100c).

Click here to view the chart => https://www.tradingview.com/x/4AnAvyHE/

➡️ Wednesday 07-February-2024, 06h30 | WHL Woolworths | Noting the 6-month trend line at risk of being breach + risk of slipping back below the 200-day SMA.

Click here to view the chart => https://www.tradingview.com/x/7MR1TZpP/

➡️ Wednesday 07-February-2024, 06h30 | Global Sentiment Index |

Click here to view the chart => https://www.tradingview.com/x/owwE5QJZ/

Lester Davids

Analyst: Unum Capital

Comments